Shop Pay vs Afterpay: A Shopper's Guide to the Two Buy Now, Pay Later Options

Shop Pay and Afterpay are two of the most popular buy now, pay later (BNPL) options available today. Both platforms offer shoppers the ability to spread out the cost of their purchases over multiple installments, making it easier to afford the things they want and need.

But which BNPL platform is right for you? In this blog post, we'll take a closer look at Shop Pay and Afterpay, comparing their features, benefits, and drawbacks. We'll also help you decide which platform is the best fit for your shopping needs.

So whether you're looking for a quick and easy way to pay for your next purchase or you're trying to build your credit, read on to learn more about Shop Pay and Afterpay and find the BNPL option that's right for you.

What is Shop pay?

Shop Pay is a buy now, pay later (BNPL) platform that is integrated with Shopify merchants. Shoppers can use Shop Pay to split the cost of their purchases into four equal payments, due every two weeks. There are no fees associated with using Shop Pay, and shoppers can use it on any Shopify store.

What is Afterpay?

Afterpay is a "Buy Now, Pay Later" (BNPL) service that allows consumers to make purchases and split their payments into smaller, interest-free installments over a specified period. Afterpay is typically used for online and in-store shopping and has become increasingly popular, especially among younger consumers.

Shop Pay vs Afterpay: Features

Shop Pay and Afterpay are both popular payment and checkout solutions, but they have distinct features and functionalities. Here's a comparison of the features of Shop Pay and Afterpay:

Shop Pay Features

- Faster Checkout: Shop Pay is primarily designed to streamline the checkout process, making it quick and hassle-free for customers.

- Stored Information: It securely stores customer information, including shipping addresses and payment details, for faster future purchases.

- Shop Pay Installments: Shop Pay offers a feature called "Installments," allowing customers to split their payments into four equal, interest-free installments. It may enhance affordability for shoppers.

- Security: Shop Pay prioritizes security and employs advanced encryption and fraud protection measures to safeguard customer data.

- Carbon Offset: Shop Pay supports sustainability efforts by automatically offsetting the carbon emissions generated by package delivery.

- Integration: Shop Pay seamlessly integrates with Shopify-powered stores, providing a unified shopping and checkout experience.

Afterpay Features

- Buy Now, Pay Later: Afterpay's core feature allows customers to split their purchase amount into four equal, interest-free payments over a few weeks.

- Approval Process: Afterpay conducts a real-time credit check during checkout to determine eligibility for the service.

- Automatic Payments: Payments are automatically deducted from the customer's linked debit or credit card on the scheduled dates.

- Late Fees: Afterpay may charge late fees if customers miss a payment, making it crucial to adhere to the payment schedule.

- Account Creation: Customers need to create an Afterpay account and agree to its terms and conditions to use the service.

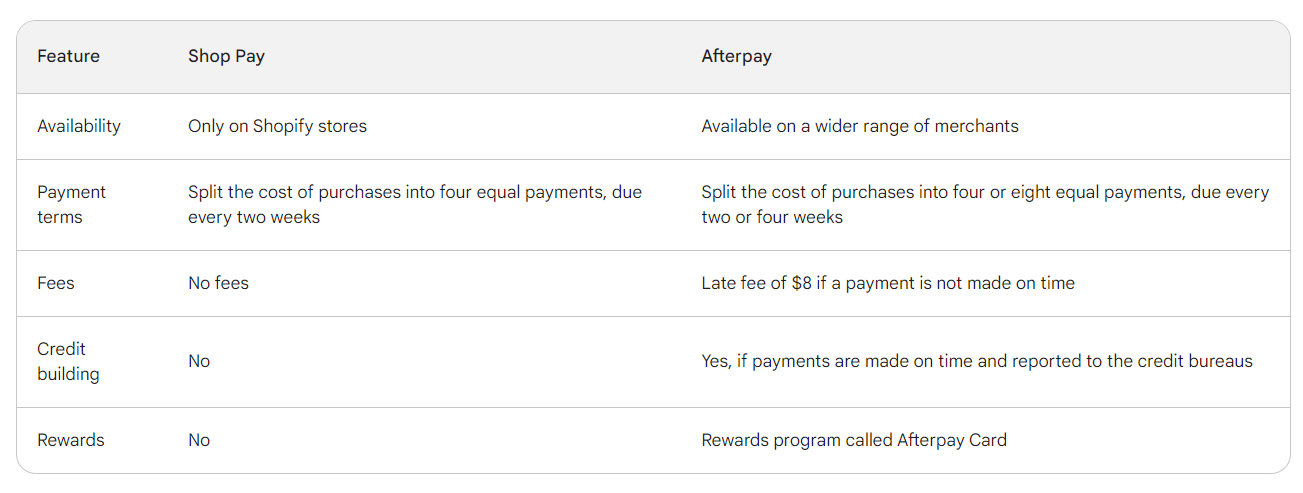

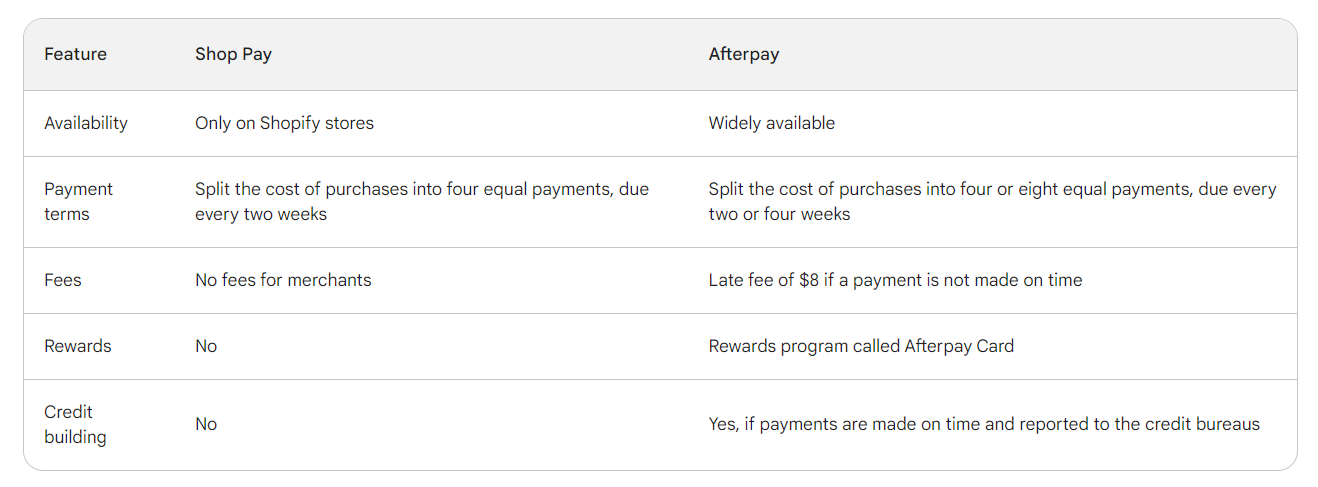

Difference between Shop pay and Afterpay

Shop Pay and Afterpay are both buy now, pay later (BNPL) platforms, but there are some key differences between the two.

Availability: Shop Pay is only available on Shopify stores, while Afterpay is available on a wider range of merchants, including both online and brick-and-mortar stores.

Payment terms: Shop Pay allows shoppers to split the cost of their purchases into four equal payments, due every two weeks. Afterpay allows shoppers to split the cost of their purchases into four equal payments, due every two weeks, or eight equal payments, due every four weeks.

Fees: Shop Pay does not charge any fees for using its BNPL platform. Afterpay charges a late fee of $8 if a payment is not made on time.

Credit building: Shop Pay does not build credit. Afterpay reports payments to the credit bureaus, which can help shoppers build their credit history.

Rewards: Shop Pay does not offer any rewards programs. Afterpay offers a rewards program called Afterpay Card that allows shoppers to earn points on their purchases.

Overall, Shop Pay is a good option for shoppers who want a convenient and easy-to-use BNPL platform that is only available on Shopify stores. Afterpay is a good option for shoppers who want a BNPL platform that is more widely available, offers rewards, and can help them build their credit history.

Here is a table that summarizes the key differences between Shop Pay and Afterpay:

Shop Pay vs Afterpay Cost

Shop Pay and Afterpay have different pricing models and plans:

Shop Pay Pricing

- Shop Pay is available for use at no additional cost for both merchants and customers.

- It's tightly integrated with the Shopify platform, and there are no subscription fees or transaction fees associated with using Shop Pay.

- Shopify merchants can offer Shop Pay as a payment option to their customers without incurring extra charges.

Afterpay Pricing

- Afterpay typically charges merchants a fee for each transaction processed through their service. This fee can vary but is usually a percentage of the order value, with an additional fixed fee per transaction.

- The specific fees may vary depending on the region, industry, and agreement between the merchant and Afterpay.

- Customers who use Afterpay are not charged interest on their purchases, but they may incur late fees if they miss a payment. These late fees are paid by the customer and do not affect the merchant's revenue.

Shop Pay vs Afterpay: Pros & Cons

Here's a comparison of the pros and cons of Shop Pay and Afterpay:

Shop Pay Pros & Cons

Pros:

- Efficient Checkout: Shop Pay is designed to streamline the checkout process, making it quick and convenient for customers.

- Stored Information: It securely stores customer information, including shipping addresses and payment details, which can speed up future purchases.

- Shop Pay Installments: Offers an "Installments" feature that allows customers to split their payments into four equal, interest-free installments, making larger purchases more accessible.

- Security: Prioritizes security with advanced encryption and fraud protection measures to safeguard customer data.

- Carbon Offset: Supports sustainability efforts by automatically offsetting the carbon emissions generated by package delivery.

- Integration: Seamlessly integrates with Shopify-powered stores, providing a unified shopping and checkout experience.

Cons:

- Limited to Shopify: Shop Pay is primarily designed for use on Shopify-powered stores, limiting its availability to a specific platform.

- Payment Splitting: While it offers payment splitting, it may not be as versatile as dedicated "Buy Now, Pay Later" services like Afterpay.

Afterpay Pros & Cons

Pros:

- Payment Flexibility: Afterpay's core feature allows customers to split their payments into interest-free installments, making it easier for them to manage their budgets.

- Broad Acceptance: Accepted by a wide range of retailers and e-commerce platforms, offering customers the flexibility to use it across different stores.

- Account Creation: Provides customers with an Afterpay account for managing their payments and purchases.

- Late Fees: Encourages timely payments by charging late fees to customers who miss a payment, which can benefit merchants.

Cons:

- Transaction Fees: Merchants typically incur transaction fees for each sale processed through Afterpay, potentially impacting their profit margins.

- Complexity: Managing Afterpay payments may introduce additional complexity for merchants, especially when dealing with late payments.

- Credit Check: Afterpay conducts a real-time credit check on customers during checkout, potentially limiting its accessibility for some shoppers.

- Focused on Payment Splitting: While it excels in payment splitting, it may not offer the same level of streamlined checkout as Shop Pay.

Shop pay reviews

Shop Pay has received generally positive reviews from shoppers. Here are some of the things that shoppers like about Shop Pay:

- Convenience: Shoppers appreciate the fact that Shop Pay is integrated with Shopify stores, so they can use it to make purchases without having to create a separate account.

- Ease of use: Shoppers say that it is easy to use Shop Pay to split their payments into four equal installments.

- Speed: Shoppers can complete their purchase with Shop Pay in just a few clicks.

- Security: Shoppers trust that their financial information is safe when using Shop Pay.

Here are some of the things that shoppers dislike about Shop Pay:

- Limited availability: Shop Pay is only available on Shopify stores, so shoppers who want to use it must shop at a Shopify store that accepts it.

- No rewards program: Shoppers who use Shop Pay do not earn points or cashback on their purchases.

- Does not build credit: Using Shop Pay does not help shoppers build their credit history.

Afterpay reviews

Afterpay has received generally positive reviews from shoppers. Here are some of the things that shoppers like about Afterpay:

- Wide availability: Afterpay is available on a wide range of merchants, both online and brick-and-mortar stores.

- Flexible payment terms: Shoppers can choose to split the cost of their purchases into four or eight equal payments, due every two or four weeks.

- Potential to build credit: Afterpay reports payments to the credit bureaus, which can help shoppers build their credit history.

- Rewards program: Shoppers who use the Afterpay Card can earn points on their purchases that can be redeemed for rewards.

Here are some of the things that shoppers dislike about Afterpay:

- Late fees: Shoppers who miss a payment are charged a late fee of $8.

- Can be addictive: Some shoppers have reported that they have become addicted to using Afterpay and have overspent as a result.

- Not available to everyone: Shoppers with bad credit or who are under 18 may not be eligible to use Afterpay.

Overall, Afterpay is a popular BNPL platform that offers shoppers a flexible way to pay for their purchases and the potential to build credit. However, shoppers should be aware of the late fees and the potential for overspending.

Shop Pay vs Afterpay: Which is best for your ecommere business?

Shop Pay is a good option for e-commerce businesses that want to offer a convenient and easy-to-use BNPL payment option to their customers. Shop Pay is integrated with Shopify, so it is easy for customers to use and merchants to set up. Shop Pay does not charge any fees for merchants, and it is available to all customers who have a Shopify account.

Afterpay is a good option for e-commerce businesses that want to offer a flexible BNPL payment option to their customers. Afterpay is available on a wide range of merchants, both online and in-store. Afterpay charges a late fee of $8 if a payment is not made on time, but it also offers a rewards program called Afterpay Card that allows customers to earn points on their purchases.

Which BNPL platform is right for your e-commerce business will depend on your specific needs and goals. If you are looking for a convenient and easy-to-use BNPL payment option, Shop Pay is a good option. If you are looking for a flexible BNPL payment option that is widely available and offers rewards and the potential to build credit, Afterpay is a good option.

Afterpay vs Shop Pay: Alternatives

Here are some alternatives to Shop Pay and Afterpay that e-commerce businesses can consider:

Klarna

- Flexible payment terms, up to 36 months

- Offers rewards program

- Can help customers build credit

Sezzle

- Flexible payment terms, up to 6 weeks

- No late fees

- Offers rewards program

Affirm

- Flexible payment terms, up to 36 months

- Offers rewards program

- Can help customers build credit

QuadPay

- Flexible payment terms, up to 4 installments

- No late fees

- Offers rewards program

Ovo

- Flexible payment terms, up to 6 weeks

- No late fees

- Can help customers build credit

Is Shop pay the same as Afterpay?

Shop Pay and Afterpay are both buy now, pay later (BNPL) platforms that allow shoppers to split the cost of their purchases into installments. Both platforms are also popular with shoppers and merchants alike.

Here are some of the similarities between Shop Pay and Afterpay:

- Convenience: Both Shop Pay and Afterpay are easy to use. Shoppers can simply check out at checkout and choose to split their payment into installments.

- Flexibility: Both Shop Pay and Afterpay offer flexible payment terms. Shoppers can choose to split their payment into four or eight equal installments, due every two or four weeks.

- Security: Both Shop Pay and Afterpay use secure payment processing methods to protect shoppers' financial information.

- Merchant benefits: Both Shop Pay and Afterpay offer merchants a number of benefits, such as increased sales, improved conversion rates, and reduced cart abandonment rates.

Is shop pay a good way to pay?

Shop Pay can be a convenient and efficient way to pay for online purchases, particularly for customers shopping on Shopify-powered stores. Its benefits include a streamlined checkout process, stored customer information for faster payments, and the option to split payments into interest-free installments.

FAQs

Here are the most frequently asked questions related to Shop pay vs Afterpay:

Is Shop Pay Safe?

Yes, Shop Pay is safe. Shop Pay uses the same secure payment processing methods as Shopify, which are PCI compliant. This means that your financial information is protected when you use Shop Pay.

.png)