Affirm vs Afterpay: Which One Is Easier to Use?

Affirm and Afterpay are two of the most popular buy now, pay later (BNPL) services on the market, but they have different strengths and weaknesses. One of the most important factors to consider when choosing a BNPL service is ease of use. After all, you want to be able to shop and pay for your purchases quickly and easily, without having to deal with complicated sign-up processes, checkout options, or payment terms.

In this blog post, we'll compare Affirm and Afterpay in terms of ease of use, including factors such as signing up, making purchases, and managing your account. By the end of this post, you'll have a good understanding of which BNPL service is easier to use for your needs.

What is Affirm

Affirm is a financial technology company that provides a payment platform allowing consumers to make purchases at online and offline retailers and pay for them over time in fixed monthly or bi-weekly installments. Instead of paying for a purchase in full upfront, consumers can choose Affirm as a payment option during checkout and then select their preferred installment plan.

What is Afterpay

Afterpay is a buy now, pay later (BNPL) service that allows you to purchase items online and in-store and pay for them in four equal installments over six weeks. There are no interest charges or fees if you make your payments on time.

To use Afterpay, you first need to create an account and provide some basic information, such as your name, address, and date of birth. Once your account is approved, you can start shopping at participating retailers. At checkout, simply select Afterpay as your payment method and enter your account information.

Affirm vs Afterpay: Features

Affirm and Afterpay are both popular "Buy Now, Pay Later" (BNPL) services, but they offer slightly different features and functionalities to consumers. Here's a comparison of their key features:

Affirm Features

Flexible Payment Options

Affirm allows consumers to choose from a range of flexible payment options, including 3, 6, 12, 18, or 24-month plans.

Interest Rates

Affirm offers fixed interest rates on its financing plans. The interest rate depends on factors like the consumer's creditworthiness and the retailer's terms.

No Late Fees

Affirm does not charge late fees for missed payments, providing some flexibility to consumers.

Transparency

Affirm provides clear and transparent information about the total cost of the purchase, including interest and fees, upfront before consumers commit to a payment plan.

Virtual Card

Affirm offers a virtual card that consumers can use for online and in-store purchases, making it easy to access their BNPL plans.

Partnered Retailers

Affirm partners with a wide range of online and offline retailers, allowing consumers to use it for various types of purchases.

Afterpay Features

Four Equal Installments

Afterpay allows consumers to split their payments into four equal, interest-free installments, with payments due every two weeks.

No Interest or Upfront Fees

Afterpay does not charge interest on its installment plans, and there are no upfront fees.

Automatic Payments

Afterpay automatically deducts payments from the customer's linked debit or credit card on the scheduled dates.

Approval Process

Afterpay conducts a real-time credit check during checkout to determine eligibility for the service.

Late Fees

Afterpay may charge late fees if customers miss a payment, which can encourage adherence to the payment schedule.

Wide Acceptance

Afterpay is accepted by a broad range of online and in-store retailers, offering consumers flexibility in where they can use it.

Afterpay vs Affirm: Pricing & Plans

Affirm and Afterpay, as "Buy Now, Pay Later" (BNPL) services, have different pricing structures and plans:

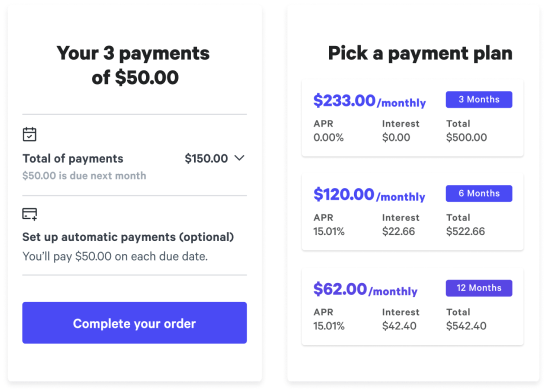

Affirm Pricing & Plans

- Interest Rates: Affirm charges interest on its financing plans, which can vary based on factors like the consumer's creditworthiness and the retailer's terms. Interest rates are typically fixed and range from 0% to 30% or more.

- Flexible Payment Terms: Affirm offers a range of flexible payment terms, including 3, 6, 12, 18, or 24 months. The specific terms available may depend on the retailer and the consumer's creditworthiness.

- No Late Fees: Affirm does not charge late fees for missed payments, providing some leniency to consumers who may encounter unexpected financial challenges.

- Transparency: Affirm provides clear and transparent information about the total cost of the purchase, including interest and fees, before consumers commit to a payment plan. This transparency helps consumers make informed decisions.

Afterpay Pricing & Plans

- No Interest: Afterpay does not charge interest on its installment plans. Customers can split their payments into four equal, interest-free installments, with payments due every two weeks.

- No Upfront Fees: Afterpay does not impose upfront fees on consumers. There are no application or origination fees to use the service.

- Late Fees: While Afterpay does not charge interest, it may impose late fees if customers miss a payment. These fees are intended to encourage timely payments and vary depending on the region and the purchase amount.

- Automatic Payments: Afterpay automatically deducts payments from the customer's linked debit or credit card on the scheduled dates, simplifying the repayment process.

Affirm vs Afterpay: Pros & Cons

Here's a comparison of the pros and cons of Affirm and Afterpay, two popular "Buy Now, Pay Later" (BNPL) services:

Affirm Pros & Cons

Pros:

- Flexible Payment Terms: Affirm offers a wide range of flexible payment terms, allowing consumers to choose plans that suit their budget and financial situation.

- Transparent Pricing: Affirm provides clear and transparent information about the total cost of a purchase, including interest and fees, before consumers commit to a payment plan.

- No Late Fees: Affirm does not charge late fees for missed payments, offering some leniency to consumers who may encounter unexpected financial challenges.

- Wide Retailer Network: Affirm partners with a broad network of online and offline retailers, giving consumers the flexibility to use it for various types of purchases.

- Interest Options: Affirm offers both interest-bearing and 0% interest options, giving consumers choices based on their creditworthiness and preferences.

Cons:

- Interest Charges: For interest-bearing plans, Affirm charges interest, which can increase the total cost of a purchase.

Afterpay Pros & Cons

Pros:

- Interest-Free: Afterpay does not charge interest on its installment plans, making it an attractive option for consumers who want to avoid interest charges.

- No Upfront Fees: Afterpay does not impose upfront fees on consumers, and there are no application or origination fees.

- Automatic Payments: Afterpay automatically deducts payments from the customer's linked debit or credit card on the scheduled dates, simplifying the repayment process.

- No Credit Check for Approval: Afterpay conducts a real-time credit check during checkout, making it accessible to a broader range of consumers without a lengthy approval process.

Cons:

- Fixed Payment Schedule: Afterpay's primary offering consists of splitting payments into four equal installments, which may not provide the same flexibility in terms of payment terms as Affirm.

- Late Fees: Afterpay may charge late fees if customers miss a payment, which can add to the cost if payments are not made on time.

Affirm vs Afterpay: Which is best for your ecommerce business

The choice between Affirm and Afterpay for your e-commerce business depends on your specific business model, target audience, and priorities. Here are some factors to consider when deciding which service is best for your e-commerce business:

Affirm May Be Best for Your E-commerce Business If:

- Flexibility is Key: Affirm offers more flexible payment terms, including longer financing options, which can be attractive to customers looking for various repayment options.

- Transparency Matters: If you prioritize transparency and want to provide customers with clear information about the total cost of their purchase upfront, Affirm's approach aligns well with this.

- Interest Options: Affirm offers both interest-bearing and 0% interest options, so you can cater to customers with different credit profiles and preferences.

- No Late Fees: Affirm does not charge late fees for missed payments, which can be seen as a customer-friendly feature.

Afterpay May Be Best for Your E-commerce Business If

- Simplicity is Preferred: If you want a straightforward payment option with a fixed, interest-free four-installment plan, Afterpay's simplicity may appeal to your customers.

- Instant Approval: Afterpay's real-time credit check allows more customers to be approved quickly, potentially increasing conversion rates.

- No Interest: Afterpay does not charge interest on its installment plans, which can be a selling point for budget-conscious customers.

- Automatic Payments: With Afterpay, payments are automatically deducted, reducing the likelihood of missed payments.

- No Upfront Fees: Afterpay does not impose upfront fees on customers, making it an attractive option for those who want to avoid additional costs.

Affirm vs Afterpay: Alternatives

While Affirm and Afterpay are popular "Buy Now, Pay Later" (BNPL) services, there are several alternatives in the market that e-commerce businesses can consider offering to their customers. Here are some notable BNPL alternatives:

- Klarna: Klarna is a well-known BNPL service that allows customers to split payments into four equal installments. It also offers features like price drop notifications and a "Pay Later" option for a 30-day payment delay.

- Sezzle: Sezzle offers interest-free installment plans with payments scheduled every two weeks. It targets budget-conscious shoppers and aims to improve cart conversion rates.

- QuadPay (Zip): QuadPay, now part of Zip, allows customers to split purchases into four interest-free payments. It offers instant approval and does not conduct a traditional credit check.

- PayPal Pay in 4: PayPal offers a BNPL service called "Pay in 4," which enables customers to split payments into four equal installments. It's integrated with PayPal accounts for convenience.

- Splitit: Splitit allows customers to pay with their existing credit cards and split payments into interest-free installments. It doesn't require additional credit checks or applications.

- Openpay: Openpay offers flexible payment plans with durations ranging from two months to 24 months. It caters to various industries, including retail, healthcare, and automotive.

- Affirm (if not already using): If you're currently using Afterpay or another BNPL service, consider adding Affirm as an alternative to provide more choices to your customers.

Is Affirm and Afterpay the same?

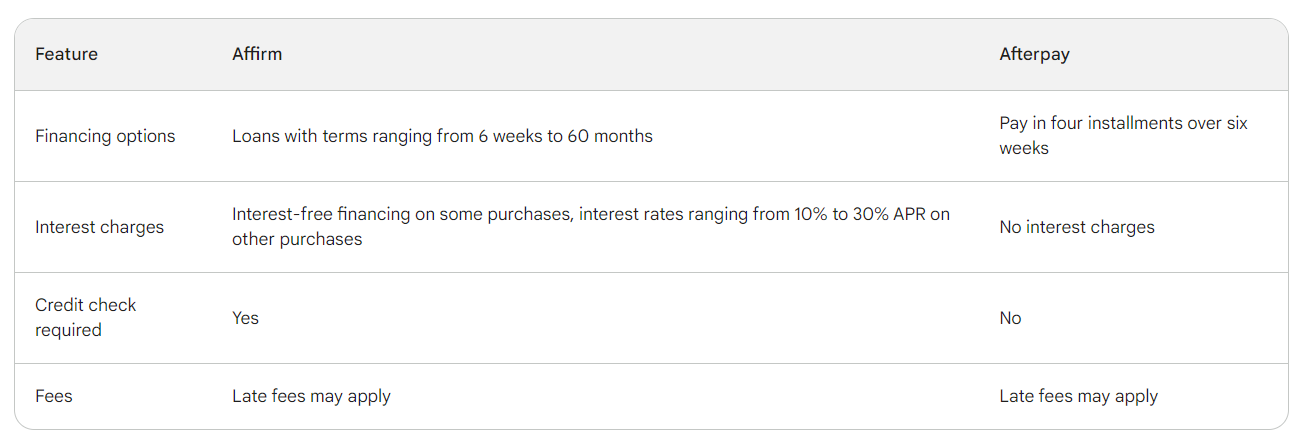

Affirm and Afterpay are both buy now, pay later (BNPL) services, but they have some key differences.

Affirm offers a variety of financing options, including loans with terms ranging from 6 weeks to 60 months. Affirm also offers interest-free financing on some purchases.

Afterpay only offers one financing option: pay in four installments over six weeks. There are no interest charges or fees if you make your payments on time.

Another key difference is that Affirm requires a credit check for all loans, while Afterpay does not require a credit check. This makes Afterpay a good option for people with bad credit or no credit history.

Here is a table that summarizes the key differences between Affirm and Afterpay:

Conclusion

So, which BNPL service is easier to use? Afterpay or Affirm? It depends on your needs and preferences. If you want a simple and straightforward option with no interest charges or fees, Afterpay is the easier choice. If you need a more flexible option with the potential to build your credit, Affirm is the better choice.

Ultimately, the best way to decide is to try both and see which one you prefer. Both services offer free sign-ups, so you can experiment without any risk.

.png)