Ecommerce Accounting: Avoiding Common Pitfalls

Navigating the financial aspects of running an online store can be challenging. Ecommerce accounting is crucial for tracking progress, managing budgets, and ensuring legal compliance. However, it's easy to stumble into common mistakes that can affect your business's financial health. This blog aims to shed light on these pitfalls and offer straightforward advice on how to avoid them. Whether you're just starting out or looking to refine your existing processes, understanding these key areas of e-commerce accounting will help you maintain a solid foundation for your business. By staying informed and proactive, you can safeguard your ecommerce venture from unnecessary financial stress and position it for sustained success. Let's dive into the essential tips and strategies to keep your online store's finances on track.

What is Ecommerce Accounting?

Ecommerce accounting involves tracking and managing the financial transactions and activities of an online store. This includes recording sales, costs, profits, and losses to provide a clear financial picture of the business. Unlike traditional retail accounting, accounting for ecommerce deals with digital transactions, online payment methods, and often, international sales and taxes. It encompasses everything from daily sales and inventory management to broader financial planning and tax filing.

Effective ecommerce accounting not only ensures that a business meets legal obligations but also aids in strategic decision-making by offering insights into financial health, customer behavior, and product performance. Given the dynamic nature of online sales, with fluctuating demand and rapid transactions, ecommerce accounting requires meticulous organization and often the use of specialized software to keep accurate and up-to-date records. Understanding ecommerce accounting is essential for any online retailer aiming to grow their business and navigate the complexities of digital commerce successfully.

How to do Accounting for Ecommerce Business?

Accounting for an ecommerce business involves several key steps to ensure financial activities are accurately recorded and managed. Here's how to approach it:

- Choose the Right Accounting Method: Decide between cash-based accounting, where transactions are recorded when cash changes hands, or accrual-based accounting, where transactions are recorded when they occur, regardless of when payment is made or received. Each has its benefits, so consider which aligns best with your business operations.

- Set Up a Dedicated Business Account: Keep your business finances separate from personal finances by setting up a business bank account. This simplifies tracking income and expenses related to your ecommerce business.

- Use Accounting Software: Invest in reliable accounting software tailored for ecommerce businesses. Good software can automate many aspects of accounting, from recording transactions to generating financial reports, saving you time and reducing errors. In addition, you should use an Invoice Template to ensure each of your sales is duly recorded. Along with other transactions, having a separate record of sales through invoices helps ease the process.

- Regularly Update Your Books: Make it a habit to update your financial records regularly. This includes sales, expenses, inventory purchases, and any other financial transactions. Regular updates provide a real-time snapshot of your business's financial health.

- Understand Your Tax Obligations: Ecommerce businesses may have complex tax obligations, especially if selling internationally. Familiarize yourself with sales tax, VAT, and other applicable taxes. Accurately track and report taxes to avoid penalties.

- Monitor Cash Flow: Keep a close eye on your business's cash flow — the money coming in and going out. Positive cash flow is crucial for covering operational costs and ensuring the business can grow.

- Review Financial Performance: Regularly review your financial statements, including profit and loss statements, balance sheets, and cash flow statements. This helps you understand your business's financial performance and identify areas for improvement.

- Seek Professional Help: Consider consulting with an accountant or financial advisor specialized in ecommerce. Professional advice can help you navigate complex financial regulations, optimize your tax strategy, and make informed business decisions.

5 Best Ecommerce Accounting Softwares

Choosing the best ecommerce accounting software is crucial for efficiently managing your online store's finances. Here are some top options, each offering unique features to cater to different needs:

QuickBooks Online

Widely recognized for its comprehensive features, QuickBooks Online simplifies accounting tasks with its intuitive interface, robust reporting, and scalability. It's ideal for small to medium-sized businesses looking for a reliable accounting solution.

Xero

Known for its user-friendly design, Xero offers real-time financial tracking, easy invoicing, and seamless integration with various ecommerce platforms. It's a great choice for businesses prioritizing accessibility and collaboration.

FreshBooks

With a focus on simplicity and automation, FreshBooks is perfect for entrepreneurs and freelancers. Its features include straightforward invoicing, expense tracking, and time tracking for service-based ecommerce businesses.

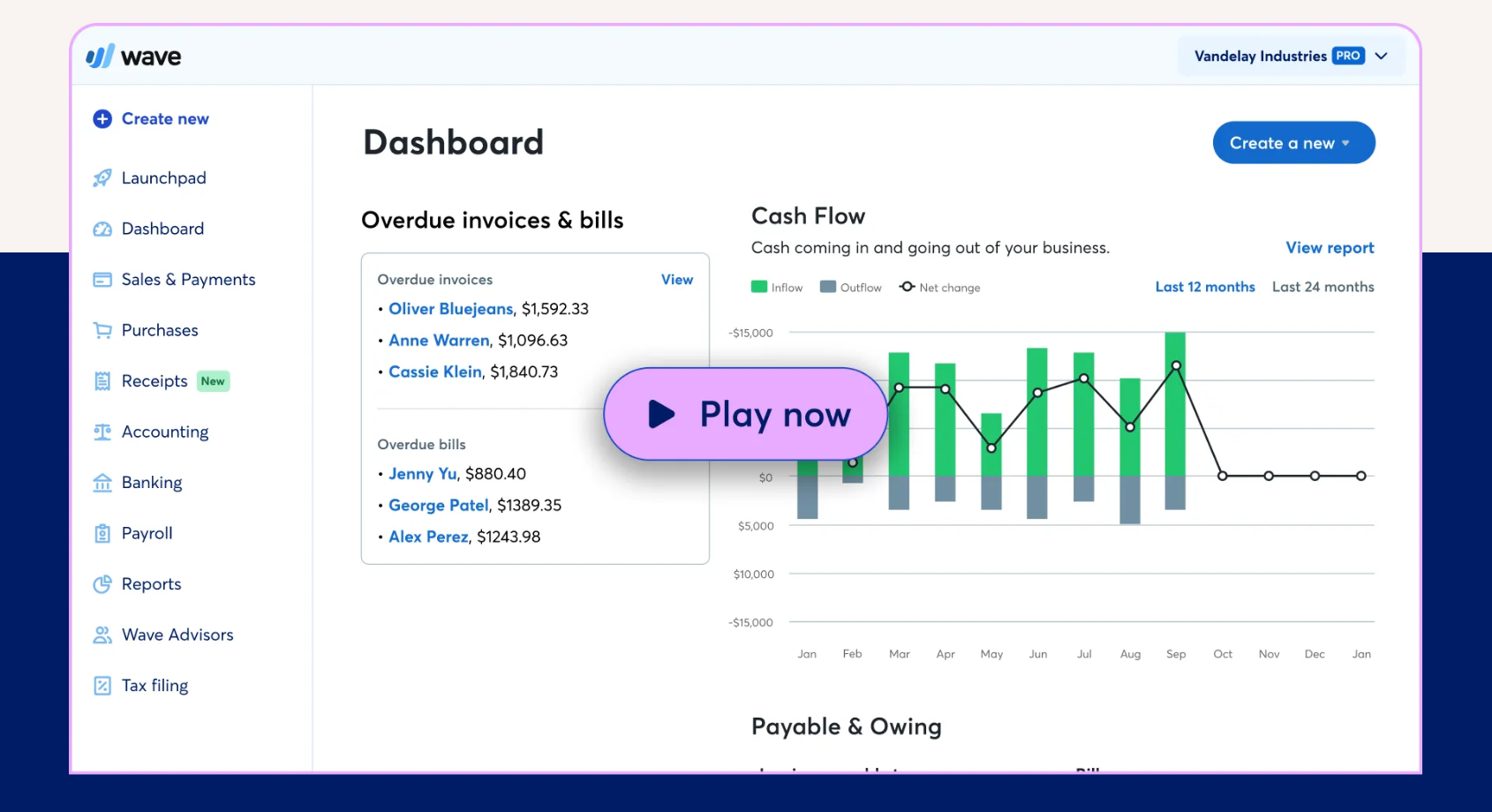

Wave

Offering a solid accounting tool for free, Wave is ideal ecommerce accounting software for startups and small businesses on a tight budget. It covers basic accounting needs, including invoicing and financial reporting, without overwhelming users with complex features.

Zoho Books

Part of the Zoho suite designed for businesses, Zoho Books stands out for its automation capabilities, comprehensive reporting, and excellent customer support. It's suitable for businesses looking for a versatile accounting solution within a broader ecosystem of business tools.

How to choose the right ecommerce accounting software?

Selecting the right ecommerce accounting software involves careful consideration of several factors to ensure it meets your business needs effectively. Here’s a structured approach to make an informed decision:

- Assess Your Needs: Start by identifying your specific accounting requirements. Consider the size of your business, the volume of transactions, inventory management needs, and any specific tax handling capabilities you may require. Understanding your needs helps narrow down the options to those that offer the features you need.

- Ease of Use: The software should have an intuitive interface that you and your team can navigate easily. A steep learning curve can lead to inefficiencies and errors. Look for software that offers a trial period so you can test its usability.

- Integration Capabilities: Your accounting software should seamlessly integrate with your ecommerce platform, payment processors, and other tools like inventory management systems. Integration ensures that data flows smoothly between systems, reducing the need for manual data entry and minimizing errors.

- Scalability: Choose software that can grow with your business. If you're planning to expand your product lines or enter new markets, your accounting software should be able to handle increased transaction volumes and additional financial complexities without requiring a system change.

- Reporting and Analytics: Good ecommerce or Shopify accounting software will provide comprehensive reporting and analytics tools. Being able to generate detailed financial reports and gain insights into your business's financial health is crucial for strategic planning and decision-making.

- Customer Support: Consider the level of customer support provided. Reliable customer service means you can get help quickly if you encounter any issues or have questions about the software.

- Cost: While cost shouldn’t be the only factor, it’s important to consider the pricing structure of the software. Evaluate what’s included in the subscription fee, like updates, customer support, and additional services. Ensure the cost aligns with your budget and the value it brings to your business.

- Compliance: Ensure the software complies with the accounting standards and tax regulations relevant to your business. This is particularly important if you operate in multiple countries or regions with different tax laws.

- Security: Given the sensitive nature of financial data, choose software with robust security measures to protect your data from unauthorized access or breaches.

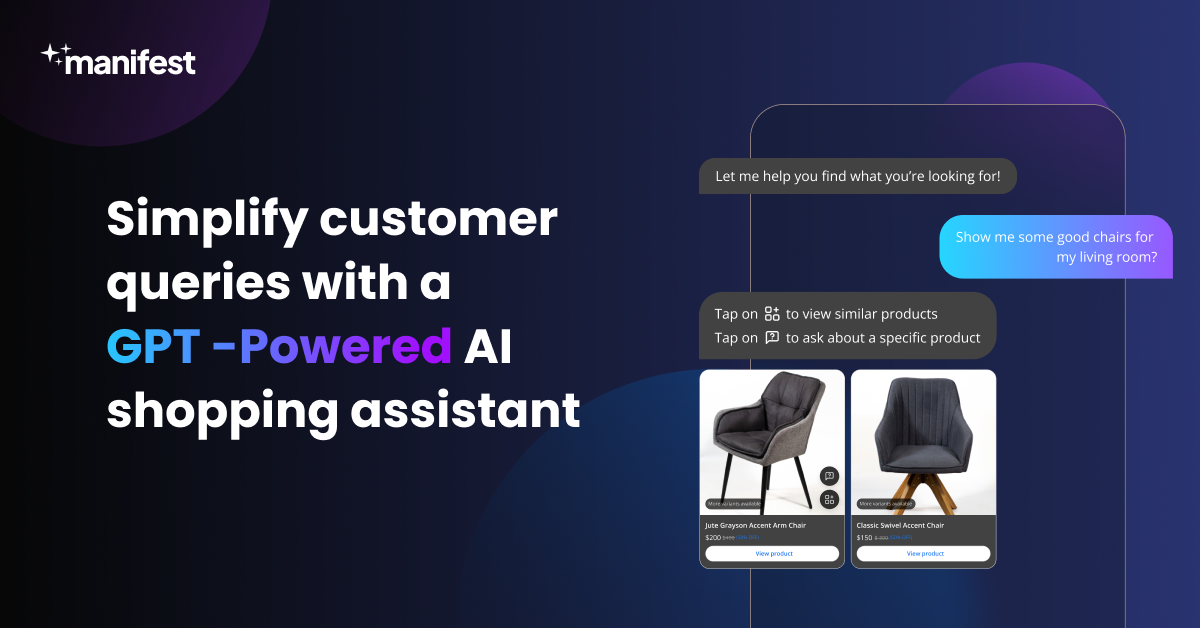

Grow your Shopify store with an AI Shopping Assistant

Manifest AI leverages GPT technology to elevate Shopify stores with enhanced customer service capabilities. By automating interactions, it delivers tailored product recommendations and support, refining the overall shopping experience. The platform equips store owners with comprehensive analytics, enabling well-informed strategies to boost their digital footprint.

Core Benefits:

- Tailored Customer Engagement: Utilizes AI to understand and cater to individual customer preferences, offering personalized guidance.

- Efficient Issue Resolution: Optimizes the handling of common inquiries, freeing up resources for more intricate customer needs.

- Enriched Buying Experience: Guides shoppers effectively, enhancing satisfaction and fostering loyalty.

- Data-Driven Insights: Gathers and analyzes customer behavior and preferences, facilitating strategic decisions to improve business operations.

Conclusion

Navigating ecommerce accounting successfully requires awareness and proactive management to avoid common pitfalls. By understanding the unique financial landscape of online business, prioritizing accurate record-keeping, and staying informed about tax obligations, ecommerce businesses can lay a solid foundation for financial health. Choosing the right tools and seeking expert advice when necessary can also make a significant difference. Remember, the goal is to ensure that your accounting practices support your business's growth and sustainability. With careful planning and attention to detail, you can turn potential challenges into opportunities for strengthening your ecommerce venture.

.png)