ShopPay Vs Paypal: Which Is Better In 2024

ShopPay and PayPal. Both offer convenient, secure checkout experiences, but which one reigns supreme in 2024? This blog dives deep into the arena, comparing fees, features, and accessibility to crown the champion for your specific needs. Whether you're a seasoned Shopify seller or a casual online shopper, buckle up as we discuss the strengths and weaknesses of PayPal vs Shop pay, helping you make the ultimate payment decision for a seamless and rewarding online experience. So, grab your virtual shopping cart, because it's time to settle the score: ShopPay vs. PayPal - who will claim victory in 2024?

ShopPay Vs Paypal: Overview

Here is the introduction for this:

ShopPay

To understand what is ShopPay, basically, ShopPay is like an express lane for online shopping. It saves your payment and shipping info, letting you checkout with a single tap on millions of Shopify stores, the Shop app, and even in some places on Facebook, Instagram, and Google. You earn rewards on every purchase and can track your orders easily. ShopPay is more focused on Shopify and its ecosystem, offering a faster, integrated experience for those who shop there often.

Paypal

PayPal is a digital wallet and payment service allowing you to send and receive money online around the world. It acts as a middleman between your bank account or credit card and merchants, offering secure transactions without sharing your financial details. Shop online, pay friends, request money, and even manage your finances all in one place. While not as focused on specific platforms like ShopPay, it boasts wider merchant acceptance and features like buyer protection and international payments.

ShopPay Vs Paypal: Features

ShopPay Features

here are the key features to understand how does shopPay work:

Faster checkout: Save your payment and shipping information once, and checkout with a single tap on your phone or computer. No more re-entering information, just grab your items and go!

Rewards that keep on giving: Earn Shop Cash with every purchase, redeemable for future shopping sprees at participating stores. It's like getting paid to shop.

Tracking your purchases made easy: Stay on top of your shopping journey with real-time order tracking within the Shop app. Never wonder where your package is again.

Beyond Shopify: While primarily focused on Shopify stores, Shop Pay is expanding its reach, offering checkout options on Facebook, Instagram, and Google.

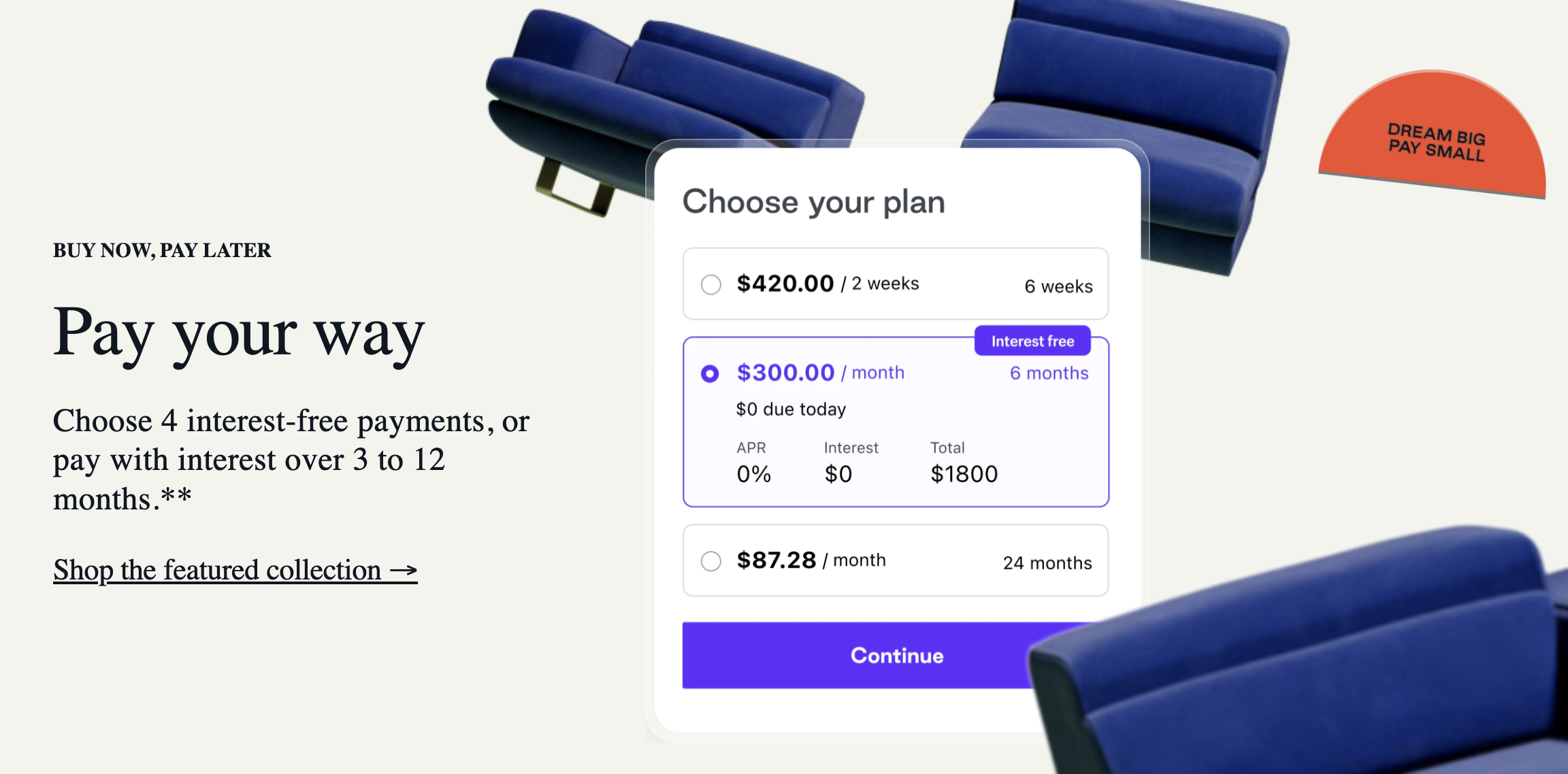

Buy Now, Pay Later (BNPL) options: ShopPay offers various BNPL options for flexible payment plans. This allows you to split your purchase into smaller installments, making it more affordable to pay for larger items.

Secure payments: ShopPay uses industry-standard security measures to protect your financial information. Your payment details are encrypted and stored securely, so you can shop with peace of mind.

Customer support: ShopPay offers 24/7 customer support to help you with any questions or problems you may have.

PayPal Features

Here's key features of PayPal:

Sending and receiving money: Transfer funds to friends and family, request payments, or split bills seamlessly. PayPal even supports international money transfers in various currencies.

Secure online shopping: Pay at millions of online stores without sharing your financial details, enjoying buyer protection for eligible purchases.

Bill pay and manage subscriptions: Ditch the hassle of juggling bills. Easily pay bills directly through PayPal and manage recurring subscriptions for a streamlined experience.

Mobile payments: Pay on the go with the convenient PayPal app, using QR codes or contactless payments at participating stores.

Rewards and savings: Earn cash back on eligible purchases and link your PayPal account to loyalty programs for additional rewards.

Financial tools: Track your spending, set budgets, and manage your finances with tools like budgeting insights and savings goals.

Cryptocurrency: Buy, sell, and hold select cryptocurrencies within the PayPal app, exploring the world of digital assets.

Marketplace: Discover unique products and services from independent sellers directly on the PayPal platform.

Business solutions: Accept payments, send invoices, manage your finances, and get access to working capital loans – all tailored for your small business needs.

Security and peace of mind: PayPal prioritizes security with advanced fraud detection and encryption technologies, giving you peace of mind for your transactions.

ShopPay Vs Paypal: Pricing

Choosing between Shop pay vs paypal cost. Let's dissect their pricing structures to help you make an informed decision:

ShopPay Pricing

No monthly fees: ShopPay has no recurring & Shop Pay installments fees, making it potentially more cost-effective for frequent users.

Transaction fees: ShopPay charges the same credit card processing fees as your chosen Shopify plan. These range from 2.4% to 2.9% + 30 cents per transaction, depending on your plan tier.

No international transaction fees: Good news for international users! ShopPay currently does not charge additional fees for transactions outside the US.

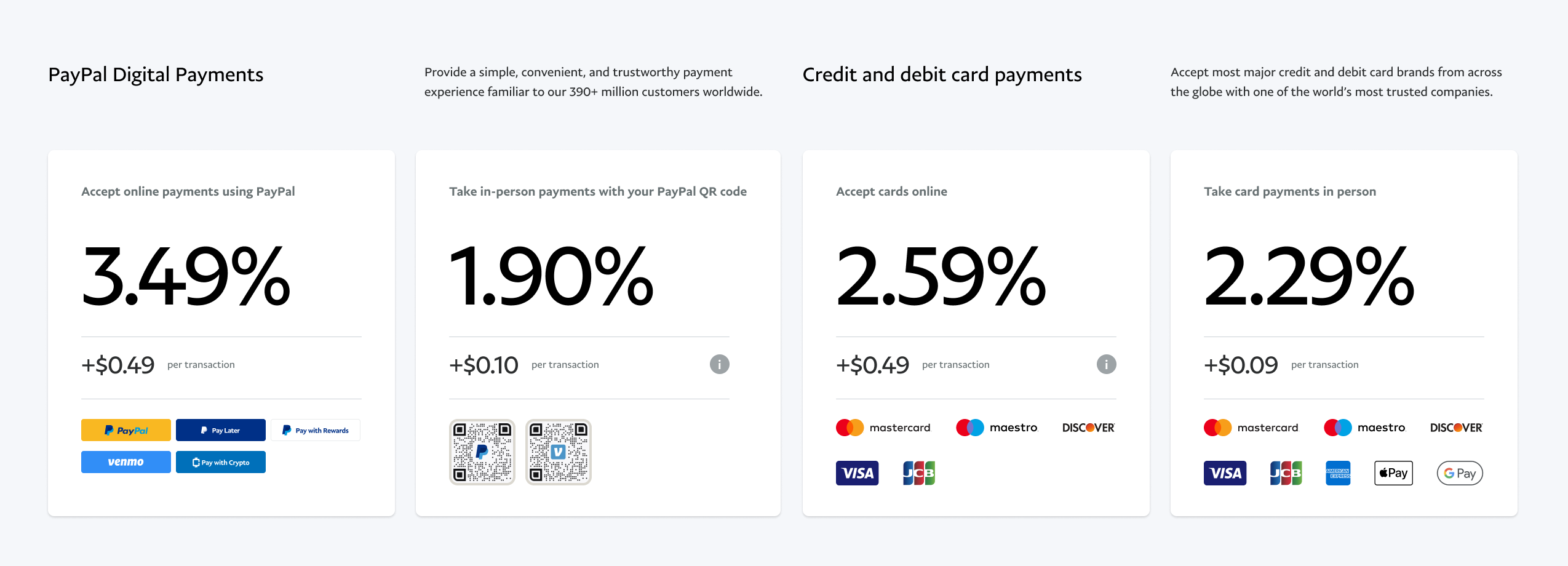

PayPal Pricing

No monthly fees: Similar to ShopPay, PayPal has no recurring fees for personal accounts.

Transaction fees: PayPal charges 2.9% + 30 cents per transaction for domestic sales in the US. For international sales, the fee jumps to 4.4% + a fixed fee based on the currency.

Currency conversion fees: If your transaction involves currency conversion, PayPal charges an additional 3.5% fee.

ShopPay Vs Paypal: Review ( Pros & Cons)

To understand ShopPay vs PayPal we’ll discuss its review, pros, and cons:

ShopPay Review

Pros

Lightning-fast checkout: Save your details once and breeze through checkout with a single tap on your phone or computer. No more form-filling delays!

Rewards that reward: Earn Shop Cash with every purchase, redeemable at participating Shopify stores. Think of it as getting paid to shop!

Integrated experience: Seamlessly checkout within the Shop app, millions of Shopify stores, and even on platforms like Facebook, Instagram, and Google (limited options).

Order tracking at your fingertips: Keep track of your purchases in real-time within the Shop app, always knowing where your package is.

Enhanced security: Enjoy secure transactions with industry-standard encryption and fraud prevention measures.

Growing ecosystem: Shop Pay is expanding its reach beyond Shopify, offering more options and convenience.

Cons

Limited merchant acceptance: Primarily focused on Shopify stores, it lacks the broader reach of competitors like PayPal.

Rewards program restrictions: Shop Cash can only be used at participating Shopify stores, limiting its flexibility.

Limited international support: Not all features and functionalities are available in all regions.

Potential for dependence: Overreliance on Shop Pay might limit your options when shopping outside the Shopify ecosystem.

Customer service concerns: Some users report mixed experiences with customer support, which could be an area for improvement.

PayPal Review

Pros

Wide Merchant Acceptance: Shop online at millions of stores worldwide that accept PayPal, offering flexibility and convenience.

Buyer Protection: Enjoy peace of mind with PayPal's money-back guarantee for eligible purchases made with your PayPal balance or credit card, protecting you from fraud and unauthorized transactions.

Multiple Funding Options: Link your bank account, credit card, debit card, or prepaid card to your PayPal account for various funding options.

Send and Receive Money: Easily send and receive money from friends and family both domestically and internationally.

Bill Pay and Subscriptions: Manage your bills and recurring subscriptions directly through PayPal, simplifying your financial organization.

Mobile Payments: Pay on the go with the convenient PayPal app, using QR codes or contactless payments at participating stores.

Financial Tools: Track your spending, set budgets, and manage your finances with tools like budgeting insights and savings goals.

Cryptocurrency: Buy, sell, and hold select cryptocurrencies within the PayPal app, exploring the world of digital assets.

Marketplace: Discover unique products and services from independent sellers directly on the PayPal platform.

Cons

Merchant Fees: Sellers often pay fees for accepting PayPal payments, which can sometimes translate to higher prices for consumers.

Transaction Fees: While sending and receiving money between friends and family is free, sending money for goods or services often incurs fees.

Limited Currency Support: Not all currencies are supported for all functionalities, potentially impacting international users.

Customer Service Concerns: Some users report experiencing difficulties with customer support, which could be an area for improvement.

Account Holds: PayPal has a reputation for occasionally freezing accounts for suspicious activity, potentially causing inconvenience and delays in accessing your funds.

ShopPay & PayPal: Alternatives

Here are some alternative payment platforms to ShopPay and PayPal:

Stripe: A popular payment processor for businesses of all sizes, Stripe offers a wide range of features, including online payments, invoicing, subscriptions, and more. It has competitive fees and is easy to integrate with your website or app.

Apple Pay: A mobile payment system developed by Apple, Apple Pay allows users to make payments using their iPhone, iPad, Apple Watch, or Mac. It is a secure and convenient way to pay online and in stores.

Google Pay: A mobile payment system developed by Google, Google Pay allows users to make payments using their Android phone or smartwatch. It is a secure and convenient way to pay online and in stores.

Venmo: A mobile payment app that allows users to send and receive money from friends and family. It is a popular choice for splitting bills and paying for small purchases.

Zelle: A mobile payment service that allows users to send and receive money from friends and family who have a bank account in the United States. It is a fast and convenient way to send money without having to share your bank account information.

Grow your Shopify store with an AI

Integrating Manifest AI into your Shopify store can significantly improve its functionality and customer interaction. This AI solution is designed to align with your customer's needs, offering a shopping experience that is both personalized and captivating. Here's how Manifest AI can drive the growth of your store:

- Tailored Product Recommendations: By analyzing customer preferences and search queries, Manifest AI can recommend products that customers are more inclined to purchase, customizing each visit.

- Efficient Customer Assistance: Manifest AI swiftly addresses common customer inquiries, ensuring prompt support.

- Enhancing Customer Engagement: The tool engages visitors by initiating conversations, providing guidance, or making suggestions, thereby increasing the likelihood of a purchase.

- Customer Insights: Manifest AI provides valuable insights into customer preferences and shopping behaviors, enabling more informed decisions regarding inventory and marketing strategies.

Is Shop Pay the same as PayPal?

No, ShopPay and PayPal are not the same, although they both serve as payment processors and offer similar features. Here's a breakdown of their key differences:

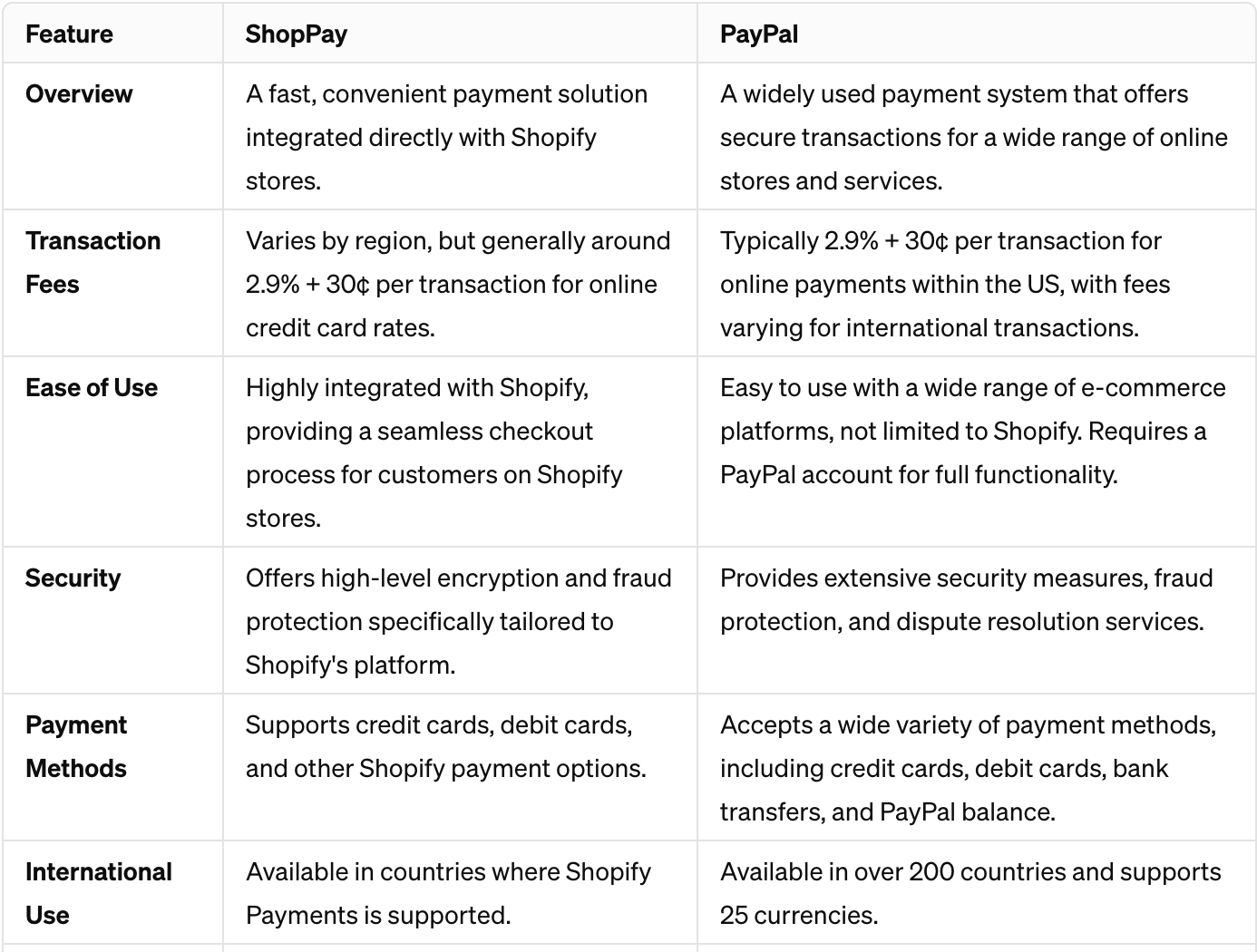

ShopPay Vs PayPal Comparison Chart:

Conclusion

Both ShopPay and PayPal bring unique strengths. ShopPay shines for speedy, integrated checkouts within the Shopify ecosystem, offering rewards and convenience for frequent shoppers there. PayPal, however, boasts broader merchant acceptance, international support, and diverse features, making it a versatile all-rounder. Ultimately, the champion depends on your individual needs. If you're a Shopify devotee seeking a streamlined experience, ShopPay might be your match. But if you value widespread accessibility, international options, and a feature-rich toolkit, PayPal could be your champion. So, weigh the pros and cons, consider your shopping habits, and choose the platform that unlocks a smoother, more rewarding checkout experience in 2024.

Frequently Asked Questions

Does Shop Pay Have Buyer Protection?

Shop Pay doesn't have a full-fledged buyer protection program like PayPal, but it offers security measures and dispute resolution options. Transactions are encrypted, and you can file disputes through Shopify if something goes wrong.

Is Shop Pay Safe?

Shop Pay is generally considered safe for online transactions, but it's important to understand its security features and limitations.

.png)