Klarna vs Affirm: Meaning, Feature, Pricing & Alternatives 2024

Klarna and Affirm have emerged as prominent players, offering flexible payment options to enhance the shopping experience for consumers. With e-commerce sales expected to continue their upward trajectory in 2024, understanding the nuances of these platforms becomes crucial for businesses aiming to cater to consumer preferences for payment flexibility. This blog will delve into the detailed difference between Klarna and Affirm to help you decide which service might be best suited to your business needs. We'll explore how each platform aims to simplify the buying process, thereby potentially increasing customer satisfaction and loyalty through convenient payment solutions.

Klarna vs Affirm: What it is?

Here is the definition or introduction of Affirm vs Klarna:

Klarna

Klarna is a Swedish fintech company that provides online payment solutions for consumers and merchants. It was founded in 2005 and has since become one of the largest and most well-known payment service providers globally. Klarna's services allow consumers to make purchases online and pay for them later through flexible payment options, such as installment plans or buy now, pay later (BNPL) arrangements.

Affirm

Affirm is a financial technology (fintech) company that offers alternative payment solutions for consumers. Similar to Klarna, Affirm provides a "buy now, pay later" (BNPL) service that allows customers to make purchases and pay for them over time through fixed installment plans. Affirm is known for providing transparent and straightforward financing options at the point of sale.

Klarna vs Affirm Features

Both Klarna and Affirm are prominent players in the "buy now, pay later" (BNPL) market, providing consumers with alternative payment options. Here's a comparison of their features:

Klarna features

Buy Now, Pay Later (BNPL): Klarna's primary feature is its "buy now, pay later" (BNPL) service. It allows consumers to make purchases and pay for them over time through installment plans, often with no interest or fees.

Installment Plans: Klarna provides flexibility in payment by allowing users to split their purchases into equal, manageable installments. This can make it easier for consumers to afford higher-cost items.

Transparent Payment Terms: Klarna emphasizes transparency by clearly displaying payment schedules and the total cost of the purchase, including any interest or fees, before the transaction is completed.

Integration with Online Stores: Klarna is integrated into the checkout process of many online retailers, providing a seamless payment experience for users. It is a widely accepted payment method on various e-commerce platformsKlarna.

No Interest or Fees (for Many Plans): Klarna offers some financing options with no interest or fees, making it an attractive choice for users who want to spread out payments without incurring additional costs.

Mobile App: Klarna provides a user-friendly mobile app that allows customers to manage their purchases, track deliveries, and access exclusive deals. The app enhances the overall shopping experience and provides a convenient way to stay informed about payments.

Variety of Payment Options: In addition to BNPL, Klarna supports various payment methods, including credit/debit cards and direct bank transfers. This flexibility allows users to choose the payment method that suits them best.

Customer Account Management: Users can create Klarna accounts to manage their purchases, view order details, and keep track of their payment history. This account management feature enhances the overall user experience.

Partnerships and Exclusive Offers: Klarna often partners with merchants to offer exclusive deals and promotions to users who choose Klarna as their payment method. This can include discounts, cashback, or other incentives.

Credit Score Consideration: Klarna, while not publicly disclosing specific Klarna credit score requirements, is generally known for being more lenient than traditional credit providers. Klarna assesses the creditworthiness of users during the application process. Eligibility for Klarna's financing options may vary based on factors beyond just credit scores, and individuals with a range of credit profiles may still be eligible.

Affirm features

Flexible Payment Plans: Affirm allows users to choose from various flexible payment plans, enabling them to split their purchases into easy-to-understand monthly payments. Users can select the repayment term that best suits their financial situation.

Transparency in Pricing: Affirm is known for its commitment to transparency. Before making a purchase, users can see the total cost, including interest (if applicable), and the exact monthly payment amounts. This transparency helps users make informed decisions.

Integration with Merchants: Affirm is integrated into the checkout processes of many online and, in some cases, physical retailers. This integration allows users to select Affirm as a payment option when making purchases.

No Hidden Fees or Prepayment Penalties:Affirm emphasizes a straightforward fee structure. There are no hidden fees, and users can pay off their balance early without incurring prepayment penalties. This provides flexibility for users who want to settle their payments ahead of schedule.

Mobile App:Affirm offers a mobile app that allows users to manage their accounts, view payment schedules, and stay informed about their purchases. The app enhances the overall user experience by providing convenient access to account information.

Soft Credit Check:Affirm typically performs a soft credit check during the application process. This type of credit inquiry does not impact the user's credit score. The soft credit check helps Affirm assess the user's creditworthiness for determining eligibility.

Loan Approval in Real-Time:Affirm provides a quick and straightforward application process, often giving users real-time loan approval. This allows users to know whether they are eligible for financing almost immediately.

Integration with Online Marketplaces:Affirm has expanded its services to integrate with various online marketplaces, allowing users to use Affirm for purchases on these platforms. This broadens the range of merchants where Affirm can be utilized.

Financial Education Resources: Affirm offers educational resources on its website to help users understand how its financing options work. This includes information on interest rates, payment terms, and responsible financial management.

Partnerships and Exclusive Offers: Affirm often collaborates with merchants to provide users with exclusive offers, such as discounts or promotional financing terms, making it an attractive option for consumers.

Klarna vs Affirm Pricing

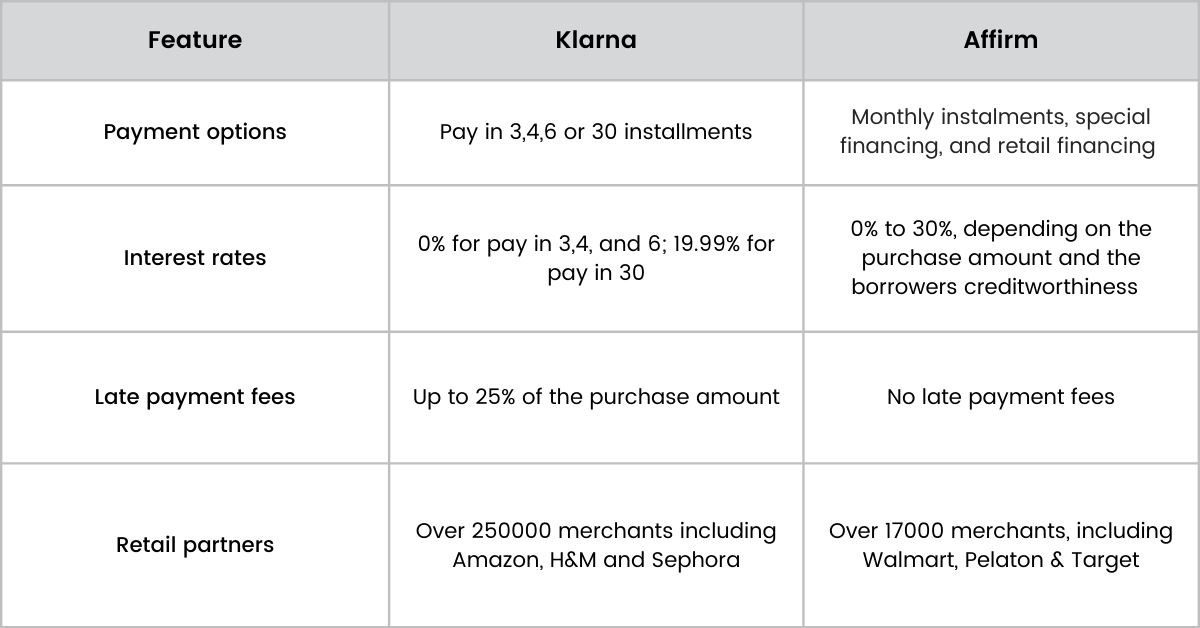

Klarna and Affirm are two of the most popular BNPL providers. Both companies offer a variety of financing options, with different terms and fees. Here is a comparison of the pricing for Klarna and Affirm:

Klarna pricing

Klarna Pay in 3: This option allows shoppers to split their purchases into three interest-free installments. There is no down payment required, and there are no late fees if you pay on time. However, if you miss a payment, you will be charged a late fee of $7.

Klarna Pay in 4: This option allows shoppers to split their purchases into four interest-free installments. There is no down payment required, and there are no late fees if you pay on time. However, if you miss a payment, you will be charged a late fee of $7.

Klarna Pay in 6: This option allows shoppers to split their purchases into six interest-free installments. There is no down payment required, and there are no late fees if you pay on time. However, if you miss a payment, you will be charged a late fee of $7.

Klarna Pay in 30: This option allows shoppers to split their purchases into 30 interest-free installments. There is no down payment required, but you will be charged interest on your purchases. The interest rate varies depending on your creditworthiness, but it can be as high as 25%.

Affirm pricing

Affirm Loan: This option allows shoppers to finance their purchases over a period of 3, 6, 12, 18, or 24 months. The interest rate varies depending on the purchase amount and your creditworthiness, but it can be as low as 0%. There are no late fees if you pay on time.

Affirm Credit Line: This option allows shoppers to access a line of credit that they can use to make purchases. The interest rate varies depending on your creditworthiness, but it can be as low as 0%. There are no late fees if you pay on time.

Affirm at Retail: This option allows shoppers to finance their purchases at participating retailers. Interest rates range from 0% to 25%, depending on the retailer and the purchase amount.

Klarna vs. Affirm: Credit Requirements

During the pay-in-four process, Klarna conducts a soft credit check that does not impact your credit score or appear on your credit report. There is no minimum credit score required for Klarna’s pay-in-four service. Although Klarna does not report timely payments for these loans to credit bureaus, missed payments may be reported.

For Klarna’s longer-term financing options, which extend up to 36 months, a hard credit check is necessary. This check assesses your credit score and payment history to determine eligibility.

When signing up with Affirm, a soft credit check is initially performed to prequalify you for purchases. However, factors such as making a purchase, your payment history, credit utilization, and the age of your account can influence your credit score.

Klarna vs. Affirm: Interest and Fees

Klarna offers interest-free payment terms provided that payments are made on time. If a payment is missed, Klarna will attempt to collect again. Should the second attempt also fail, the overdue amount will be included in the next scheduled payment, with an additional charge of $7.

Affirm operates with full transparency and does not impose any hidden fees. The company does not levy late fees on its loans, regardless of payment timeliness. To date, Affirm has processed over 16 million transactions without charging a single late fee. Affirm generates revenue by charging businesses a fee for facilitating financing, and some customers may also pay interest on their loans.

Klarna vs Affirm: Pros and Cons

Let's compare the pros and cons of Klarna and Affirm:

Klarna:

Pros:

Widespread Acceptance: Klarna is widely accepted and integrated into the checkout processes of numerous online retailers, offering users a broad range of options for using the service.

No Interest or Fees (for Many Plans): Klarna often provides financing options with no interest or fees, making it an appealing choice for users who want to spread out payments without incurring additional costs.

Transparent Payment Terms: Klarna emphasizes transparency by displaying payment schedules and the total cost before completing a transaction, helping users understand their financial commitments.

Mobile App: Klarna's user-friendly mobile app enhances the overall shopping experience, allowing users to manage purchases, track deliveries, and access exclusive deals.

Credit Score Consideration: Klarna is generally considered more lenient than traditional credit providers, with eligibility often extending to individuals with a range of credit profiles.

Cons:

Potential Late Fees: While Klarna advertises "no interest" and "no fees" for many plans, users should be aware of potential consequences for missed payments, such as late fees.

Limited to Online Shopping: Klarna's primary presence is in the online shopping space, so it may not be as accessible for in-store purchases.

Affirm:

Pros:

Flexible Payment Plans: Affirm offers various flexible payment plans, allowing users to choose repayment terms that align with their financial situation.

Transparency in Pricing: Affirm is known for its transparent pricing, displaying the total cost, including interest, before users commit to a purchase. This helps users make informed decisions.

No Hidden Fees or Prepayment Penalties: Affirm does not charge hidden fees, and users can pay off their balance early without facing prepayment penalties, providing flexibility for users.

Quick Loan Approval: Affirm often provides real-time loan approval, allowing users to know their eligibility for financing almost immediately.

Financial Education Resources: Affirm offers educational resources to help users understand how its financing options work, promoting financial literacy.

Cons:

Interest Charges: Some Affirm financing options may include interest charges, which users need to consider when evaluating the overall cost of their purchases.

Limited In-Store Integration: While Affirm is integrated into the checkout processes of many online retailers, its in-store presence may be more limited compared to online usage.

Klarna vs Affirm Reviews

Here are some honest reviews from customers of Klarna and Affirm:

Klarna reviews

Positive reviews of Klarna

- Convenience: Klarna is a convenient way to shop online and spread out the cost of purchases.

- No interest: Klarna does not charge interest on its pay-in-4 installments or pay later options.

- Variety of payment options: Klarna offers a variety of payment options, so users can choose the one that best suits their needs.

- Easy to use: Klarna is easy to use and integrate with online stores.

- Widely accepted: Klarna is accepted by a wide range of merchants, including major retailers such as Amazon, H&M, and Sephora.

Negative reviews of Klarna

- Late payment fees: Klarna charges late payment fees of up to $15.

- Credit checks: Klarna performs a soft credit check on all users, which can temporarily lower credit scores.

- Potential for overspending: Klarna can make it easy to overspend, as users can make purchases without having to pay upfront.

- Limited customer service: Klarna has been criticized for its limited customer service.

Affirm reviews

Positive reviews of Affirm

- 0% APR: Affirm offers 0% APR on many purchases, making it a more affordable option than other BNPL providers.

- No late payment fees: Affirm does not charge late payment fees.

- Variety of payment options: Affirm offers a variety of payment options, so users can choose the one that best suits their needs.

- Easy to use: Affirm is easy to use and integrate with online stores.

- Widely accepted: Affirm is accepted by a wide range of merchants, including Walmart, Peloton, and Target.

Negative reviews of Affirm

- Interest rates: Affirm's interest rates can be high for some purchases, especially for those with less-than-perfect credit.

- Hard credit checks: Affirm performs a hard credit check on all users, which can lower credit scores.

- Potential for overspending: Affirm can make it easy to overspend, as users can make purchases without having to pay upfront.

- Limited customer service: Affirm has been criticized for its limited customer service.

Klarna Vs Affirm: Which is best for an e-commerce business?

Factors to consider when choosing between Klarna and Affirm for e-commerce businesses:

Target audience: Klarna is a good option for businesses that target a younger demographic, as it is more popular with millennials and Gen Z. Affirm is a good option for businesses that target an older demographic, as it is more popular with Baby Boomers and Gen X.

Sales volume: Klarna is a good option for businesses with a high sales volume, as it can help them increase conversion rates. Affirm is a good option for businesses with a lower sales volume, as it can help them attract new customers.

Average order value: Klarna is a good option for businesses with a low average order value, as it can help them make their products more affordable to customers. Affirm is a good option for businesses with a high average order value, as it can help them spread out the cost of purchases over time.

Integration Ease: Evaluate how easily each platform integrates into your e-commerce platform. Both Klarna and Affirm offer plugins and APIs for integration, but you'll want a solution that seamlessly fits with your existing system.

Klarna vs Affirm Alternatives

Klarna and Affirm are two of the most popular BNPL providers, but there are several other alternatives available. Here are a few of the most popular:

Afterpay: An Australian BNPL provider that offers four interest-free payments over six weeks. It is popular among younger demographics and widely accepted by retailers worldwide.

Sezzle: An American BNPL provider that offers four interest-free payments over six weeks. It is similar to Afterpay and targets a similar audience.

Splitit: An Israeli BNPL provider that allows users to split their purchases into up to 48 interest-free installments. It is a good option for larger purchases and has a strong presence in the US and Australia.

PayPal Pay Later Options: A suite of BNPL options offered by PayPal, including Pay in 4, Pay Later, and PayPal credit. It is a versatile option with a large user base and acceptance network.

Zip (formerly Quadpay): An Australian BNPL provider that offers four interest-free payments over six weeks. It is a popular choice in Australia and New Zealand, and it has recently expanded into the US.

Laybuy: A New Zealand BNPL provider that offers six interest-free weekly payments. It is popular in New Zealand and Australia and has a growing presence in other markets.

Which is better Klarna or Affirm?

Both Klarna and Affirm are popular buy-now, pay-later (BNPL) providers that offer a variety of payment options to help businesses increase sales and conversion rates. The best BNPL provider for your business will depend on a number of factors, including your target audience, sales volume, and average order value.

Klarna is a good option for businesses that target a younger demographic, as it is more popular with millennials and Gen Z. Affirm is a good option for businesses that target an older demographic, as it is more popular with Baby Boomers and Gen X.

Klarna is also a good option for businesses with a high sales volume, as it can help them increase conversion rates. Affirm is a good option for businesses with a lower sales volume, as it can help them attract new customers.

Ultimately, the best way to decide which BNPL provider is right for your business is to experiment with both and see which one works best for you.

Conclusion

Choosing between Klarna and Affirm involves more than just comparing features and pricing; it's about aligning with your customer's preferences and your business goals. Both platforms offer innovative solutions that can transform the shopping experience by providing flexibility and convenience at checkout. This detailed comparison of Klarna and Affirm, along with their alternatives, should equip you with the knowledge to make an informed decision that could enhance customer satisfaction and drive sales. Remember, the right payment option can significantly impact the purchasing decision, making it vital to select a partner that resonates with your market and operational strategy.

Frequently asked questions

Here are the most frequently asked questions related to Klarna and Afterpay:

Does Klarna affect credit?

Yes, Klarna can affect your credit in a few different ways, including soft and hard credit checks, payment history, and debt-to-income ratio. To use Klarna responsibly, only use it for affordable purchases, make payments on time, keep your DTI low, be aware of potential hard credit checks, and monitor your credit report regularly.

Does Affirm report to credit bureaus?

Yes, Affirm reports to credit bureaus, but not all of your loans will be reported. Affirm only reports loans that are over $1,000 and have a hard credit check. This means that your smaller loans will not be reported to your credit score. Affirm reports your payment history to Experian, so if you make your payments on time, it can help you build your credit score. However, if you miss a payment, it will be reported to Experian and could damage your credit score.

Is Affirm and Klarna the same?

No, Affirm and Klarna are not the same. They are both buy-now, pay-later (BNPL) providers, but they have some key differences. Klarna offers a wider range of payment options, including pay-in-3, pay-in-4, pay-later, and financing, while Affirm focuses on 0% APR financing for qualified purchases. Additionally, Klarna performs soft credit checks for all transactions, while Affirm only performs hard credit checks for loans over $1,000.

.png)