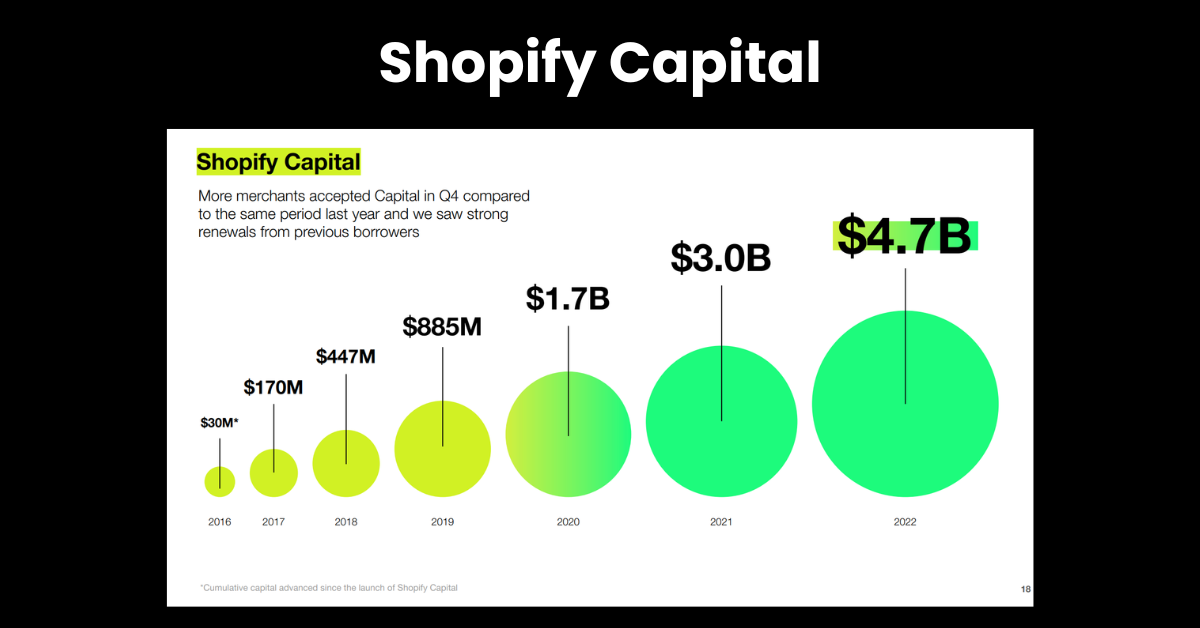

Shopify Capital: Introduction, How It Works, Review ( Pros & Cons)

Not being able to afford your Shopify ambitions? Shopify Capital could be the solution. Without affecting your credit score, this integrated financing solution guarantees easy access to funds for marketing, inventory, and other needs. However, you must comprehend how it operates, the application procedure, and any prospective benefits and drawbacks before you get started. This blog explores Shopify Capital in great detail, taking you step-by-step through all the details, from qualifying requirements to repayment conditions.

What Is Shopify Capital?

Shopify Capital is a financing program specifically designed for businesses selling through the Shopify platform. It offers merchant cash advances and loans to eligible businesses, aimed at providing quick and convenient access to capital for various needs like stocking inventory, investing in marketing, expanding operations, or hiring staff.

Unlike traditional loans, Shopify Capital loan doesn't require a personal credit check, instead relying on your store's performance and engagement with the Shopify platform to determine eligibility and loan amounts.

Shopify Capital: Requirements

Before you get excited about Shopify Capital's potential, it's crucial to understand whether your business qualifies. Here's a breakdown of the key Shopify Capital requirements or How to get Shopify Capital:

Basic Eligibility

Sell on Shopify: This one's a no-brainer! You need to be an active Shopify merchant to be considered.

Business Location: Currently, Shopify Capital is available in the United States, Canada, the United Kingdom, and Australia.

Minimum Activity: Your store should have been operating on Shopify for at least 90 days.

Shopify Standards: You must comply with Shopify's Acceptable Use Policy and Terms of Service.

Underwriting and Eligibility Determination

Machine Learning: Shopify utilizes an automated system that analyzes your business data, including sales history, disputes, and customer engagement, to determine your initial eligibility and pre-qualified funding amount.

No Personal Credit Check: Unlike traditional loans, the Shopify Capital agreement doesn't require a personal credit check, focusing on your store's performance instead.

Additional Considerations: In some cases, your business credit history might be reviewed, and factors like payment disputes, chargebacks, and buyer engagement can influence your eligibility and offered amount.

How Does Shopify Capital Work?

Shopify Capital offers two primary funding options: merchant cash advances and loans. Both provide immediate access to capital, but they differ in their repayment structure and associated fees. Here's a breakdown:

Merchant Cash Advances

Concept: You receive a lump sum of cash in exchange for a fixed percentage of your future sales.

Repayment: You automatically repay a portion of your daily sales (the remittance rate) until the advance plus the associated fee is fully paid.

Transparency: The total amount to be repaid (including the advance and fee) is disclosed upfront.

Fees: The fee is calculated as a percentage of the advanced amount and varies depending on your risk profile and loan terms.

Pros: Quick access to funds, no personal credit check, predictable repayment schedule.

Cons: Higher effective interest rate compared to loans, repayment tied to sales which can be unpredictable.

Loans

Concept: You receive a fixed sum of money with a fixed interest rate and a set repayment term.

Repayment: You make fixed monthly payments until the loan and interest are fully paid.

Transparency: Loan terms, including interest rate, repayment period, and total amount payable, are outlined clearly.

Fees: May include origination fees and late payment fees.

Pros: Predictable monthly payments, potentially lower effective interest rates than merchant cash advances.

Cons: May require higher sales volume to qualify, a longer application process, personal credit check might be required in some cases.

Shopify Capital: Review (Pros & Cons)

Shopify Capital offers a tempting solution for quick and convenient funding, but before diving in, it's crucial to weigh the pros and cons carefully. Here's a comprehensive Shopify Capital eligibility review:

Pros

Quick and Easy Access: No personal credit check, streamlined application process, and funds delivered fast.

Flexible Funding Options: Choose between merchant cash advances and loans depending on your needs and repayment preferences.

Transparent Fees: Upfront pricing with clear disclosure of total cost, no hidden fees or surprises.

Integrated Experience: Manage everything seamlessly within your Shopify dashboard, simplifying funding management.

No Impact on Personal Credit: Doesn't affect your credit score, unlike traditional loans.

Cons

Higher Effective Costs: Merchant cash advances can have higher effective interest rates than traditional loans, and loan rates might not be the most competitive.

Limited Control: Repayment for merchant cash advances is tied to sales, potentially impacting your cash flow and profitability.

Eligibility Restrictions: Not all Shopify merchants qualify, and specific criteria are not fully transparent.

Early Repayment Penalties: Early repayment might come with fees, reducing potential cost savings.

Limited Funding Amounts: May not be suitable for larger funding needs or long-term growth plans.

Shopify Capital: Interest Rate

Shopify Capital doesn't use traditional interest rates for either their Merchant Cash Advances or Loans. Instead, they utilize a fixed fee and a remittance rate for Merchant Cash Advances and a fixed loan term with a fixed monthly payment for Loans.

Here's a breakdown of how they handle costs instead of Shopify Capital interest rates:

Merchant Cash Advances

Fixed Fee: This is a percentage of the advanced amount and varies depending on your risk profile and loan terms. It's essentially the "interest" charged upfront.

Remittance Rate: This is a fixed percentage Shopify Capital rate of your daily sales that is automatically deducted until the advance and fee are fully repaid. This is similar to how interest accrues on traditional loans, but instead of being calculated based on the outstanding balance, it's directly tied to your daily sales.

Loans

Fixed Loan Term: This is the set amount of time you have to repay the loan (e.g., 6 months, 1 year).

Fixed Monthly Payment: This is the amount you're required to pay each month until the loan is fully repaid. This includes both the principal (original loan amount) and the interest charged. However, instead of a traditional interest rate, the cost is spread out evenly over the loan term through the fixed monthly payments.

Shopify Capital: Alternatives

While Shopify Capital can be a convenient option for quick funding, it's not the only game in town. Here's a glimpse into some popular alternatives:

Traditional Bank Loans

Pros: Lower interest rates compared to Shopify Capital, longer repayment terms, and potential tax benefits.

Cons: Stricter eligibility requirements, focus on personal credit score, longer application process.

Small Business Administration (SBA) Loans

Pros: Government-backed loans with competitive interest rates and flexible terms, suitable for longer-term growth plans.

Cons: Extensive paperwork, stringent approval process, may require a business plan and collateral.

Line of Credit

Pros: Access funds as needed, only pay interest on what you use, flexibility for managing short-term expenses.

Cons: Personal credit score heavily influences approval, and potential for high interest rates if not managed responsibly.

Merchant Cash Advance Providers

Pros: Similar to Shopify Capital in offering quick funding, no personal credit check required.

Cons: Often higher fees compared to Shopify Capital, shorter repayment terms, potential for predatory lenders.

Crowdfunding Platforms

Pros: Raise capital from a large pool of investors, potential for community engagement and brand awareness.

Cons: Uncertain success, platform fees, need for a compelling campaign and strong marketing efforts.

Peer-to-Peer Lending

Pros: Borrow directly from individuals, potentially lower interest rates than traditional loans.

Cons: Not as readily available as other options, platform fees, risk of borrower default.

Grow your Shopify store by implementing AI

Implementing AI through Manifest AI can significantly enhance the growth of your Shopify store. By utilizing this AI tool, you can offer personalized shopping experiences to your customers. Manifest AI analyzes user behavior to provide tailored product recommendations, ensuring that customers find exactly what they're looking for. Additionally, it automates customer service by efficiently handling inquiries, allowing you to focus on other aspects of your business. This level of personalization and efficiency not only improves customer satisfaction but also increases conversion rates and fosters loyalty. With Manifest AI, your Shopify store can operate more intelligently, adapting to the needs of your customers and setting a strong foundation for sustained growth.

Conclusion

Shopify Capital might seem like a magic wand for your e-commerce dreams, but remember, it's just one tool in your financial toolbox. This deep dive explored its workings, from eligibility and application processes to the intricate details of fees and repayment structures. We weighed the pros and cons, highlighting the convenience, transparent fees, and flexible repayment options, balanced against the higher effective costs, limited funding options, and potential impact on cash flow. Ultimately, the decision rests with you. Remember, responsible financial planning, understanding your specific needs, and exploring alternatives are key to making the best choice for your business.

.png)