12 Best Payment Gateways for Shopify in 2024

Did you realize online businesses lose $21.8 billion a year due to abandoned carts?

A large amount of this loss can be ascribed to the absence of easy and safe ways to make payments. Offering a range of Shopify payment options is essential for turning website visitors into devoted clients in today's cutthroat e-commerce market.

Selecting the best payment gateway for your Shopify business can have a significant impact on both your checkout procedure and your sales. It might be difficult to choose the best solution for your business when there are so many to choose from.

We've put up a list of the top 12 Shopify payment processing gateways in 2024 to assist you in making an informed choice. This thorough guide will examine the features, advantages, and Shopify payment gateway fees.

Why do you need the best payment provider for Shopify?

Selecting the best payment provider for your Shopify store is crucial for several reasons, as the choice can significantly impact your business's success. Here are some key reasons why having the right payment provider is important:

Customer Trust and Confidence

A reputable payment provider helps build trust and confidence among your customers. People are more likely to make purchases if they recognize and trust the Shopify payment processors available on your website.

Security and Fraud Protection

The best payment processor for Shopify prioritizes security, offering robust encryption and fraud prevention measures. This protects both you and your customers from unauthorized transactions and ensures sensitive information is kept secure.

Global Reach and Currency Support

A top payment provider should support a wide range of currencies and cater to an international audience. This allows you to expand your customer base beyond geographical boundaries and provides a seamless experience for customers around the world.

Smooth Checkout Experience

The checkout process is a critical aspect of the customer journey. The best payment providers integrate seamlessly with your Shopify store, providing a smooth and hassle-free checkout experience. Complicated or unreliable payment systems can lead to abandoned carts and lost sales.

Compatibility with Shopify Features

A good payment provider should integrate well with Shopify's features and functionalities. This ensures that you can leverage the full potential of the Shopify platform, including order tracking, inventory management, and other essential ecommerce tools.

Transparent Pricing and Fees

Understanding the pricing structure and fees associated with a payment provider is crucial for budgeting and financial planning. The best providers are transparent about their costs, helping you make informed decisions based on your business needs.

Customer Support

In the event of any issues or questions, reliable customer support from the payment provider is essential. Quick and efficient support can help resolve problems promptly and minimize disruptions to your business.

Compliance with Regulations

Different regions have various regulations related to online payments. A good payment provider ensures compliance with these regulations, reducing the risk of legal issues and ensuring a smooth operation of your e-commerce business.

Scalability

As your business grows, your payment provider should be able to scale with you. The best providers offer solutions that accommodate increasing transaction volumes and evolving business needs.

Reputation Management

The reputation of your business can be influenced by the payment options you offer. Using a well-known and trusted payment provider can positively impact how customers perceive your brand.

What is Shop Pay?

What payment processor does Shopify use?

Shopify offers a variety of payment processors, including both its own built-in solution and third-party options. The specific processor used by a Shopify store depends on various factors such as the store's location, the types of payments they want to accept, and their specific business needs. We’ll discuss both Payment gateways for Shopify.

Features to Consider When Choosing a payment gateway for your online store in Shopify

When choosing the best payment gateway for your Shopify store, it's important to consider several features to ensure a smooth and secure payment process for your customers.

Here are key features to consider:

Shopify Payments Integration

If available in your region, consider using Shopify Payments, Shopify's built-in payment gateway. It provides seamless integration, simplifying the setup process and potentially offering lower transaction fees.

Accepted Payment Methods

Ensure that the payment gateway supports a variety of payment methods, including major credit cards, debit cards, and popular digital wallets (e.g., PayPal, Apple Pay, Google Pay).

Global Support

If you have an international customer base, choose a payment gateway that supports multiple currencies and is capable of handling transactions from different regions.

Transaction Fees

Understand the fee structure, including transaction fees, monthly fees, and any additional costs. Compare fees among different gateways to find a cost-effective solution for your business.

Security Features

Prioritize security by choosing a payment gateway that complies with industry standards (PCI DSS compliance). Look for features such as encryption, fraud detection, and secure data storage to protect sensitive customer information.

Ease of Use and Integration

Select a payment gateway that seamlessly integrates with Shopify and provides an easy setup process. The goal is to have a user-friendly experience for both you and your customers.

Mobile Compatibility

With the increasing use of mobile devices for online shopping, ensure that the payment gateway is optimized for mobile responsiveness. The checkout process should be smooth on both desktop and mobile platforms.

Payout Schedule

Check the payout schedule of the payment gateway. Some gateways offer daily payouts, while others may have longer settlement periods. Choose a schedule that aligns with your business's financial needs.

Customer Support

Consider the quality of customer support provided by the payment gateway. Responsive and knowledgeable support is crucial for addressing any issues or concerns that may arise.

Recurring Billing Support

If your business involves subscription models or recurring billing, make sure the payment gateway supports these features.

Customization Options

Look for a payment gateway that allows some level of customization to maintain a consistent brand experience. This includes the ability to customize the checkout page to align with your store's branding.

12 best payment gateways for Shopify in 2024

Here are the top 12 payment gateways for Shopify stores in 2024, with an overview of the top 5 that are the best Shopify payment gateways USA market:

Shopify Payments

Integrated directly with your Shopify store, simplifies the setup process and eliminates the need for a third-party gateway.

Pros:

- Seamless integration with Shopify stores, simplifying setup

- No need for a third-party gateway

- Competitive transaction fees

- Access to Shopify's fraud protection and dispute resolution services

Cons:

- Limited payment options compared to third-party gateways

- May not be available in all countries

- May not be suitable for businesses with high-risk transactions

PayPal

PayPal is the best payment gateway for Shopify, renowned for its user-friendly interface and widespread acceptance, ideal for stores aiming for a global reach.

Pros:

- Widespread acceptance and brand recognition

- User-friendly interface and easy setup

- Suitable for businesses targeting global customers

- Offers PayPal Credit and other financing options

Cons:

- Higher transaction fees than some competitors

- May have longer transaction processing times

- Can be restrictive for high-risk businesses

Stripe

Stripe offers a clean, modern interface with powerful tools for subscription services and flexible API for customization which makes it the best payment gateway for Shopify.

Pros:

- Modern interface with powerful customization options

- Ideal for subscription-based businesses

- Flexible API for integration with other business systems

- Strong security features and fraud protection

Cons:

- May be more complex to set up than some other gateways

- Not as widely accepted as PayPal

- May not be the most cost-effective option for smaller businesses

Square

Great for businesses that sell both online and in-person, offering a unified solution for all sales channels.

Pros:

- Unified solution for online and in-person payments

- Easy to set up and use

- Competitive transaction fees

- Integrates with other Square products, such as POS systems and inventory management

Cons:

- Limited international reach

- May not be suitable for businesses with high-volume transactions

- Not as customizable as Stripe

Authorize.Net

Known for its robust security features and extensive network of merchant and partner relationships, suitable for larger businesses.

Pros:

- Robust security features and fraud protection

- Extensive network of merchant and partner relationships

- Suitable for larger businesses with high-volume transactions

- Supports a wide range of payment methods, including international cards and currencies

Cons:

- Higher transaction fees than some competitors

- Complex setup process and may require technical expertise

- May not be the best option for smaller businesses

Other notable third-party Shopify payment gateways include:

- Amazon Pay

- Braintree

- 2Checkout (now Verifone)

- WorldPay

- Adyen

- Klarna

- Skrill

Amazon Pay

Integrates with your Amazon account, offering a familiar payment experience to a vast number of online shoppers.

Pros:

- Integrates with your Amazon account, offering a familiar payment experience to a vast number of online shoppers.

- Offers a variety of payment methods, including credit cards, debit cards, Amazon gift cards, and Amazon Prime balances.

- Low transaction fees for small businesses.

Cons:

- Not as widely accepted as some other payment processors.

- May not be suitable for businesses that sell high-risk products or services.

Braintree

A PayPal service offering advanced payment features and strong support for mobile app integration.

Pros:

- A PayPal service offering advanced payment features and strong support for mobile app integration.

- Offers a variety of payment methods, including credit cards, debit cards, PayPal, Apple Pay, and Google Pay.

- Highly customizable payment experience.

Cons:

- Higher transaction fees than some other payment processors.

- May require more technical expertise to set up and integrate.

2Checkout (now Verifone)

Focuses on global payment processing, offering localized payment options across the world.

Pros:

- Focuses on global payment processing, offering localized payment options across the world.

- Supports over 150 currencies and 180 payment methods.

- Strong fraud prevention and chargeback protection.

Cons:

- Can be complex to set up and integrate.

- Higher transaction fees for some regions.

WorldPay

One of the global leaders in payment processing, offering a range of traditional and modern payment methods.

Pros:

- One of the global leaders in payment processing, offering a range of traditional and modern payment methods.

- Supports over 120 currencies and 140 countries.

- Highly secure and compliant payment processing.

Cons:

- Can be expensive for small businesses.

- May not be as user-friendly as some other payment processors.

Adyen

Adyen provides a seamless payment experience across online, mobile, and in-store channels.

Pros:

- Provides a seamless payment experience across online, mobile, and in-store channels.

- Supports over 250 currencies and 150 countries.

- Offers a variety of advanced payment features, such as recurring payments and 3D Secure.

Cons:

- Can be complex to set up and integrate.

- Higher transaction fees than some other payment processors.

Klarna

Known for its "buy now, pay later" service, offering flexible payment options to customers.

Pros:

- Known for its "buy now, pay later" service, offering flexible payment options to customers.

- Can help businesses increase sales by offering interest-free payment options.

- Popular among younger consumers.

Cons:

- May not be suitable for all businesses, as it can increase the risk of chargebacks.

- Not as widely accepted as some other payment processors.

Skrill

Offers an easy-to-use platform with a focus on low-cost international money transfers.

Pros:

- Offers a variety of payment methods, including credit cards, debit cards, bank transfers, and alternative payment methods.

- Popular in Europe and the UK.

- Offers a high level of security and fraud protection.

Cons:

- Not as widely accepted as some other payment processors.

- Higher transaction fees for some regions.

Shopify payment gateway fees

Please note that these are just the base transaction fees. The actual fees you pay may vary depending on your business type, processing volume, and other factors.

Here is a summary of the fees for each payment gateway:

Shopify Payments: Shopify Payments has the lowest transaction fees for US-based businesses, at 2.9% +$0.30. However, its international fees are slightly higher, at 3.2% +$0.30.

PayPal: PayPal is a popular choice for businesses of all sizes, thanks to its wide acceptance and user-friendly interface. However, its transaction fees are slightly higher than Shopify Payments, at 2.9% + 30¢.

Stripe: Stripe is a good choice for businesses that need a lot of flexibility and customization. However, its transaction fees are slightly higher than Shopify Payments and PayPal, at 2.9% +$0.30.

Square: Square is a good choice for businesses that sell both online and in-person. However, its international fees are slightly higher than Shopify Payments and PayPal, at 3.5% +$0.15.

Authorize.Net: Authorize.Net is a good choice for larger businesses that need robust security features and a wide range of payment options. However, its transaction fees are the highest of the five payment gateways we compared, at 2.9% + $0.30.

Amazon Pay: The transaction fee for Amazon Pay is based on your sales volume. If you do less than $10,000 in sales per month, you will pay a 2.9% + $0.30 transaction fee. If you do more than $10,000 in sales per month, you will pay a 2.5% + $0.30 transaction fee.

Braintree: The transaction fee for Braintree is based on your sales volume and the type of payment. For in-person payments, the transaction fee is 2.9% + $0.30. For online transactions, the transaction fee is 2.9% + $0.30 for credit cards and 2.9% + $0.30 for ACH payments.

2Checkout (now Verifone): The transaction fee for 2Checkout (now Verifone) is based on your sales volume and the country where your customers are located. For US customers, the transaction fee is 2.9% + $0.30. For international customers, the transaction fee is 3.9% + $0.30.

WorldPay: The transaction fee for WorldPay is based on your sales volume and the type of payment. For in-person payments, the transaction fee is 2.9% + $0.30 or credit cards and 3.9% + $0.30 for debit cards. For online transactions, the transaction fee is 2.9% + $0.30 for credit cards and 2.9% + $0.30 for ACH payments.

Adyen: The transaction fee for Adyen is based on your sales volume and the type of payment. For in-person payments, the transaction fee is 2.9% + $0.30 for credit cards and 3.9% + $0.30 for debit cards. For online transactions, the transaction fee is 2.9% + $0.30 for credit cards and 2.9% + $0.30 for ACH payments.

Klarna: The transaction fee for Klarna varies depending on the country and the type of payment. For example, in the US, the transaction fee for the "buy now, pay later" service is 3.25% + $0.30.

Skrill: The transaction fee for Skrill is 1.9% +€0.20 for online transactions. For in-person transactions, the transaction fee is 2.9% + €0.20.

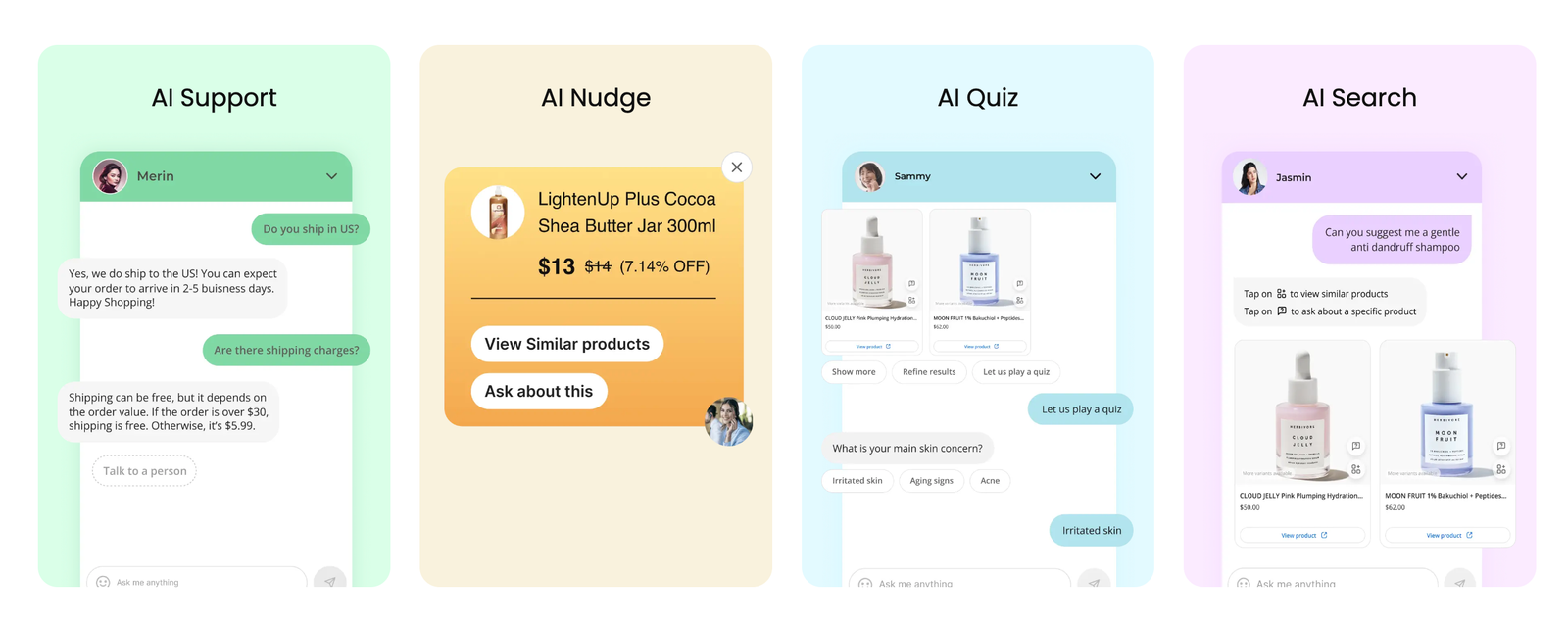

Enhancing Customer Engagement with Manifest AI in Payment Processes

As an AI chatbot tailored for Shopify, Manifest AI excels in improving customer interaction, offering support and tailored product recommendations, thus complementing the seamless transaction experience provided by top payment gateways.

In the context of selecting the best payment gateway for Shopify in 2024, integrating Manifest AI can further enhance your store's efficiency and customer experience:

- Enhanced Customer Support: Offers real-time assistance during payment processes, addressing queries and concerns.

- Personalized Shopping Experience: Manifest AI provides product recommendations, improving customer engagement and potentially increasing sales.

- 24/7 Availability: Ensures continuous support, particularly useful in international transactions across different time zones.

Conclusion

The best payment gateway for your Shopify store will depend on your specific needs and requirements. However, some of the most popular and well-respected options include Shopify Payments, PayPal, Stripe, Square, and Authorize.Net. Shopify Payments is a good choice for businesses that are already using Shopify, as it is easy to set up and use. PayPal is a popular choice for businesses of all sizes, thanks to its wide acceptance and user-friendly interface. Stripe is a good choice for businesses that need a lot of flexibility and customization. Square is a good choice for businesses that sell both online and in-person. Authorize.Net is a good choice for larger businesses that need robust security features and a wide range of payment options.

.png)