Square vs Stripe: Which Payment Processor is Best for Online Businesses?

If you're an online business owner, you know that choosing the right payment processor is essential. You need a processor that's reliable, secure, and easy to use. You also need one that offers competitive rates and fees.

Two of the most popular payment processors for online businesses are Square and Stripe. But which one is right for you?

In this blog post, we'll compare and contrast Stripe or Square to help you decide which one is the best fit for your business. We'll cover everything from features and pricing to customer support and ease of use.

What is Square?

Square is a financial services and digital payments company that was founded in 2009 by Jack Dorsey and Jim McKelvey. It is headquartered in San Francisco, California, and has offices in several other cities around the world. Square provides a range of financial services to businesses, including payment processing, point-of-sale (POS) systems, and business loans.

Square's payment processing platform allows businesses to accept credit and debit cards, mobile payments, and contactless payments. Square also offers a variety of POS hardware, including its popular Square Reader and Square Terminal. Square's business loans are designed to help businesses of all sizes get the funding they need to grow.

Square is a popular choice for businesses of all sizes, from small businesses and startups to large enterprises. It is known for its easy-to-use platform and its competitive rates and fees.

What is Stripe?

Stripe is a technology company specializing in online payment processing services for businesses. It serves as a payment gateway, enabling businesses to securely accept various forms of online payments, including credit and debit cards, digital wallets, and other online payment methods. Stripe is known for its developer-friendly approach, offering robust APIs and documentation to facilitate easy integration into websites and applications. The platform also supports international payments in multiple currencies, handles subscription-based services, and provides tools for customizable checkouts and revenue optimization. Additionally, Stripe offers features for secure payouts to businesses and includes reporting and analytics tools for insights into transaction data.

Square vs Stripe: Features

Square and Stripe are two prominent companies in the field of payment processing, but they have slightly different focuses and features. Here's a comparison of their key features so you can understand whether stripe or square is the right choice for your business:

Square:

Point of Sale (POS) Systems: Square is well-known for its hardware and software solutions for in-person payments, making it popular among brick-and-mortar businesses.

In-Person Payments: Square offers a range of card readers, terminals, and POS systems to process payments in physical locations. This includes options for contactless and chip card payments.

Online Store Integration: Square provides e-commerce tools for businesses to create and manage online stores, making it a suitable choice for both in-person and online sales.

Inventory Management: Square offers features for tracking and managing inventory, making it useful for retail businesses.

App Marketplace: Square has an extensive marketplace of third-party apps that can be integrated to extend functionality, including tools for accounting, marketing, and employee management.

Employee Management: Square includes features for managing employee schedules, timecards, and payroll.

Customer Relationship Management (CRM): It offers basic CRM features to help businesses track customer information and preferences.

Square Capital: Square provides business financing options through its Square Capital program, offering loans to eligible businesses.

Stripe:

Online Payments Focus: Stripe is primarily focused on online payment processing, making it a popular choice for e-commerce businesses and online services.

Developer-Friendly: Stripe is known for its developer-friendly approach, offering robust APIs and documentation for easy integration into websites and applications.

Subscription and Recurring Payments: Stripe provides tools for managing subscription-based services, making it ideal for businesses with recurring billing models.

International Payments: Stripe supports transactions in multiple currencies, making it suitable for businesses with a global customer base.

Customizable Checkout: Stripe offers tools for customizing the checkout experience, allowing for branded and seamless payment flows.

Payouts: In addition to accepting payments, Stripe facilitates payouts to businesses, which is useful for marketplaces or businesses with multiple sellers.

Strong Focus on Developers: Stripe provides advanced features for developers, including tools for handling complex pricing structures, preventing fraud, and managing disputes.

Advanced Analytics and Reporting: Stripe offers in-depth reporting and analytics tools, providing businesses with insights into transaction data and customer behavior.

Stripe vs Square Market share

According to 6Sense, Stripe has a 36.13% market share in the payment-management market, while Square has a 3.74% market share. This means that Stripe is the more popular payment processor, with a significantly larger market share than Square.

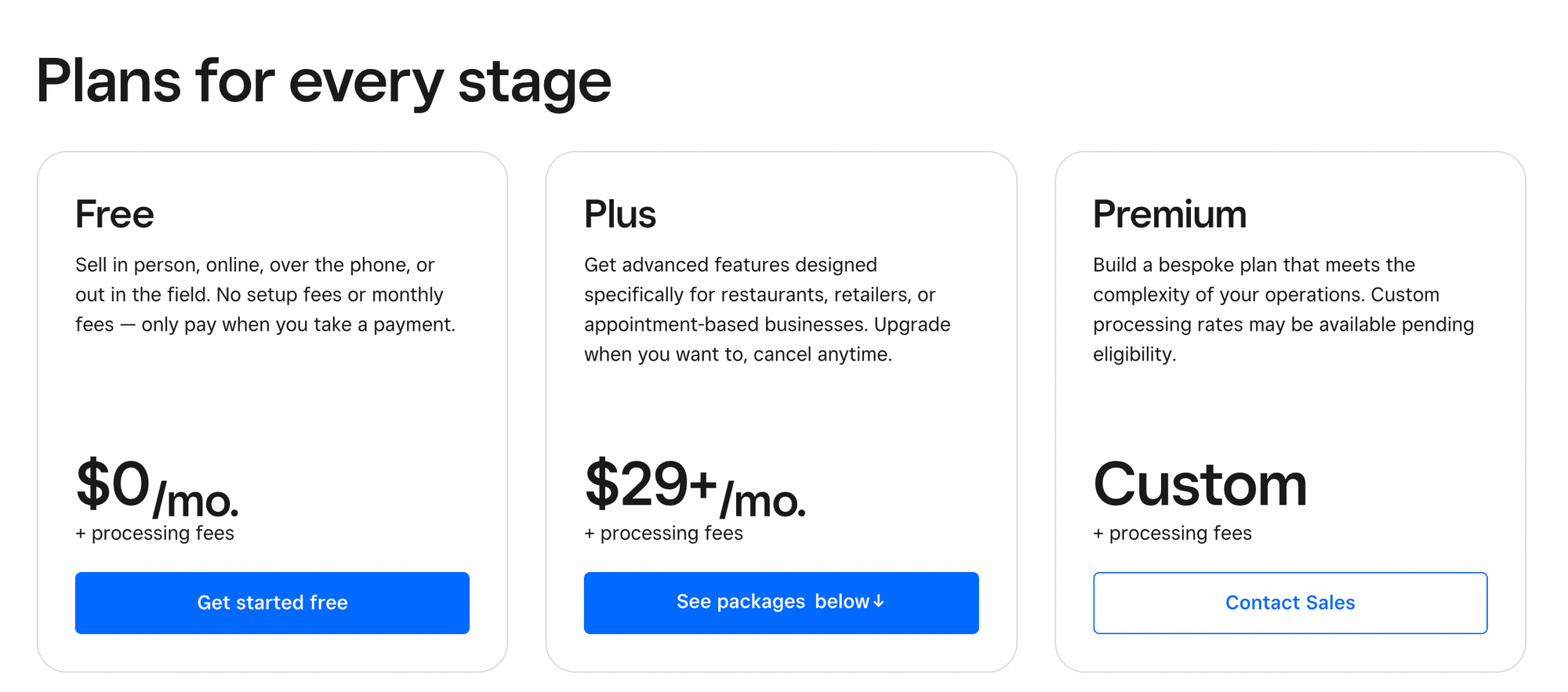

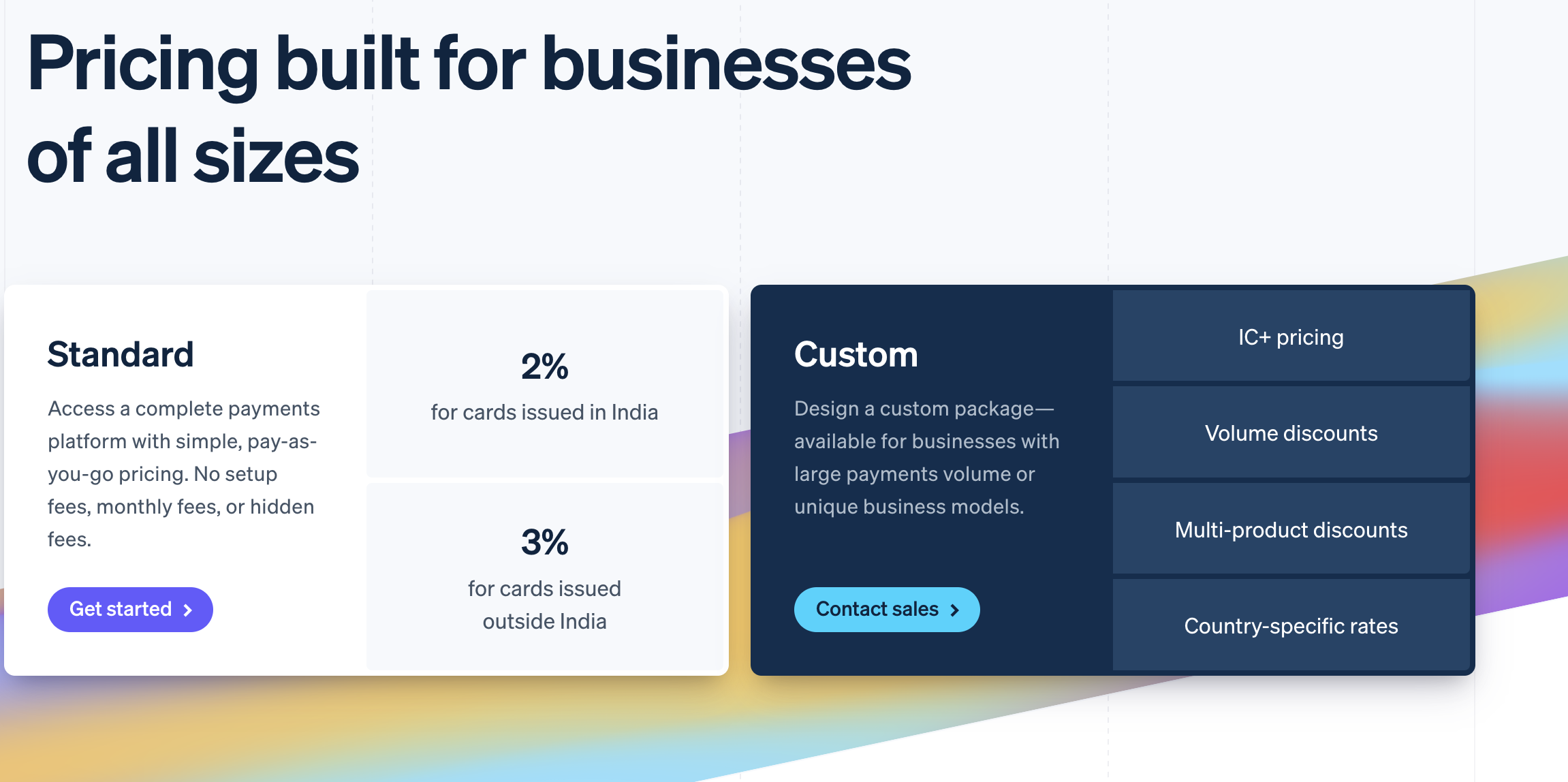

Square vs Stripe: Pricing

Square and Stripe both offer transparent pricing, with no hidden fees or monthly charges. However, there are some key differences in their pricing structures.

Square Pricing

- Transaction fees: Square charges a flat 2.6% + $0.10 per transaction for credit and debit cards. For American Express cards, the fee is 3.5% + $0.15 per transaction.

- International transaction fees: Square charges an additional 1% for international transactions.

- Chargeback fees: Square does not charge any chargeback fees.

Stripe Pricing

- Transaction fees: Stripe charges a flat 2.9% + $0.30 per transaction for credit and debit cards. For American Express cards, the fee is 3.5% + $0.30 per transaction.

- International transaction fees: Stripe charges an additional 1% for international transactions.

- Chargeback fees: Stripe charges a $15 fee per chargeback.

In general, in comparison to stripe vs square fees, Square's pricing is slightly lower than Stripe's. However, Stripe does offer some additional features, such as support for more currencies and payment methods.

Square vs Stripe: Pros and Cons

Here's a comparison of the pros and cons of Square and Stripe:

Square:

Pros:

User-Friendly Interface: Square offers an intuitive and easy-to-use interface, making it accessible for businesses without advanced technical skills.

Hardware Integration: Square provides a range of POS hardware options, including card readers and terminals, making it ideal for businesses with in-person transactions.

All-in-One Solution: It offers a comprehensive suite of services, including POS systems, payment processing, online store integration, and inventory management.

Inventory Management: Square includes features for tracking and managing inventory, which is especially useful for retail businesses.

Online Store Integration: Square allows businesses to set up and manage online stores, providing a seamless integration between online and in-person sales channels.

Employee Management: Square offers tools for managing employee schedules, timecards, and payroll.

Cons:

Limited Customization: Compared to Stripe, Square may offer fewer options for developers looking to customize payment flows.

International Support: While Square has expanded internationally, it may not offer as comprehensive support for businesses operating outside of the United States.

Stripe:

Pros:

Developer-Focused: Stripe is highly regarded for its developer-friendly approach, providing robust APIs and documentation for easy integration into websites and applications.

Online Payment Expertise: Stripe is specifically designed for online payment processing, making it an excellent choice for e-commerce businesses and online services.

Subscription and Recurring Payments: It offers robust tools for managing subscription-based services, making it suitable for businesses with recurring billing models.

International Payments: Stripe supports transactions in multiple currencies, making it ideal for businesses with a global customer base.

Customizable Checkout: Stripe provides extensive tools for customizing the checkout experience, allowing for branded and seamless payment flows.

Payouts and Marketplace Support: Stripe facilitates payouts to businesses, which is crucial for marketplaces or businesses with multiple sellers.

Cons:

Steep Learning Curve for Non-Developers: While Stripe is highly flexible, it may require more technical expertise for businesses without dedicated development resources.

Limited In-Person Payment Support: While Stripe has expanded its in-person offerings, it may not be as feature-rich as Square for businesses with physical locations.

Square vs Stripe: Reviews

Square and Stripe are both highly rated payment processors, with positive reviews from businesses of all sizes. Here are some excerpts from customer reviews of Square and Stripe:

Square Reviews

- "Square is the easiest payment processor I've ever used. I was able to set it up and start accepting payments in minutes."

- "Square's rates and fees are very competitive. I'm saving money on every transaction since I switched to Square."

- "Square offers a wide range of features, including point-of-sale, inventory management, and payroll. I'm able to run my entire business with Square."

Stripe Reviews

- "Stripe is a great payment processor for developers. It's easy to integrate Stripe into my applications and I have access to a wide range of APIs and tools."

- "Stripe offers competitive rates and fees. I'm happy with the amount of money I'm saving on transaction fees since I switched to Stripe."

- "Stripe is a reliable and secure payment processor. I've never had any problems with Stripe."

Square vs Stripe: Which is best for an e-commerce business?

Stripe is generally considered to be the better choice for e-commerce businesses. It offers a wider range of features, including support for more currencies and payment methods, as well as more advanced fraud prevention and chargeback management tools. Stripe integrations expand its capabilities, seamlessly connecting with various platforms and systems to enhance its functionality. Stripe is also more developer-friendly, making it easier to integrate into custom e-commerce platforms.

However, Square is a good option for smaller e-commerce businesses that are just getting started. It is easier to use and has lower transaction fees. Square also offers a variety of point-of-sale hardware and software solutions, which can be useful for e-commerce businesses that also have a physical storefront.

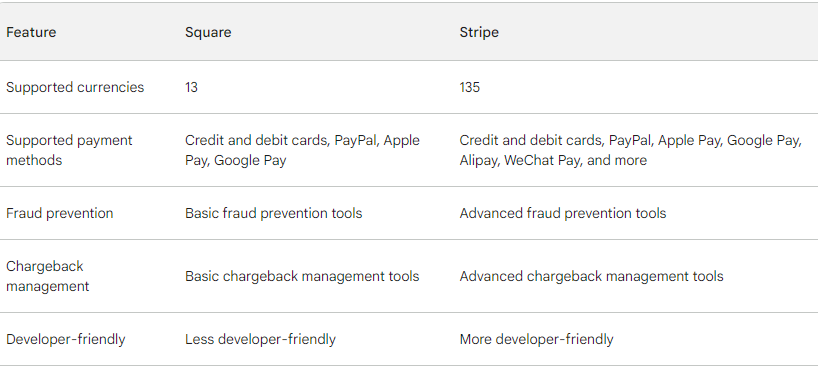

Here is a table that summarizes the key differences between Square and Stripe for e-commerce businesses:

Here are some additional factors to consider when choosing a payment processor for your e-commerce business:

Integrations: Both Square and Stripe offer a variety of integrations with other e-commerce platforms, such as Shopify, WooCommerce, and Magento. However, some integrations may be available on one platform but not the other.

Customer support: Square and Stripe both offer good customer support, but some users may prefer one platform's support over the other.

Scalability: Both Square and Stripe are scalable payment processors that can handle a high volume of transactions. However, if you expect to experience rapid growth, Stripe may be a better choice, as it offers more features and support for larger businesses.

I recommend that you compare the features and pricing of Square and Stripe to see which platform is the best fit for your e-commerce business. You can also try both platforms for free to see which one you prefer.

Square vs Stripe: Alternatives

There are several alternatives to Square and Stripe for payment processing and related services. Here are some notable options:

PayPal

PayPal is one of the most widely used online payment platforms, offering various services including payment processing, invoicing, and the ability to create online stores.

Braintree

Braintree is a full-stack payment platform that offers global payment processing, seamless integration, and advanced features for e-commerce businesses.

Authorize.Net

Authorize.Net is a payment gateway service that enables businesses to accept payments online. It offers features like fraud prevention, subscription billing, and e-check processing.

Adyen

Adyen is a global payment company that provides a single platform for accepting payments in-store, online, and through mobile devices. It supports various payment methods and currencies.

Payoneer

Payoneer offers cross-border payment solutions for businesses and professionals. It enables easy sending and receiving of funds in multiple currencies.

WePay

WePay is a payment processing platform that offers APIs for seamless integration into websites and applications. It is particularly known for supporting crowdfunding and platform businesses.

Dwolla

Dwolla is a payment platform that provides a secure and cost-effective way to send, receive, and manage payments. It's known for its ACH (Automated Clearing House) payment capabilities.

Worldpay

Worldpay is a global payment processing company that offers a range of services including in-store, online, and mobile payments.

Shopify Payments (for Shopify users)

For businesses using the Shopify e-commerce platform, Shopify Payments provides a convenient integrated payment processing solution.

PayU

PayU is a leading online payment service provider in regions like Europe, Latin America, and Asia. It offers a range of online payment solutions for businesses.

Skrill

Skrill is an online payment platform that allows businesses to send and receive payments globally. It offers various services including a digital wallet and prepaid card.

Amazon Pay

Amazon Pay enables Amazon customers to use their stored Amazon payment methods to make payments on external websites.

Square vs Stripe: Similarities

Square and Stripe are similar in several ways, as they both provide payment processing solutions for businesses. Here are some of the key similarities between Square and Stripe:

Online Payment Processing: Both Square and Stripe specialize in online payment processing, allowing businesses to accept payments over the Internet.

User-Friendly Interfaces: They both offer user-friendly interfaces that make it relatively easy for businesses to set up and start accepting payments.

Developer-Friendly: While Stripe is particularly known for its developer-friendly approach, both platforms offer APIs and developer tools for integrating their payment services into websites and applications.

Support for Multiple Payment Methods: They both support a wide range of payment methods, including credit and debit cards, digital wallets, and other online payment options.

Security and Compliance: Both Square and Stripe prioritize security and comply with industry-standard security protocols to protect sensitive payment information.

International Payments: Both platforms support transactions in multiple currencies, allowing businesses to accept payments from customers around the world.

Subscription and Recurring Payments: They both offer features for managing subscription-based services, making them suitable for businesses with recurring billing models.

Customizable Checkout: Both Square and Stripe provide tools for customizing the checkout experience, allowing for branded and seamless payment flows.

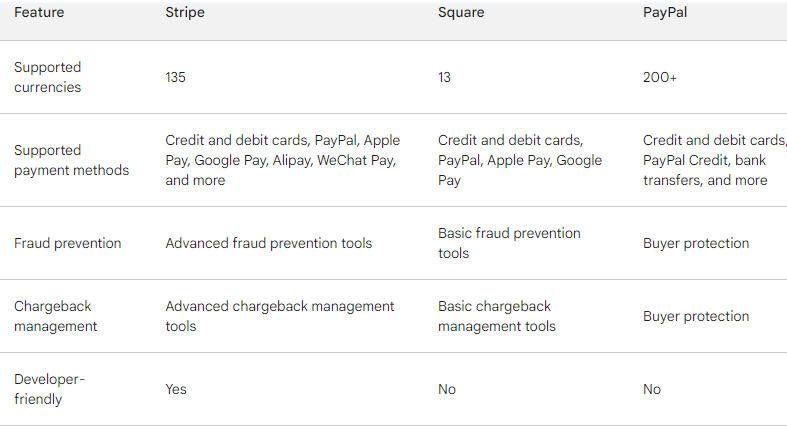

Stripe vs Square vs PayPal

Final thoughts

Square and Stripe are both excellent payment processors for online businesses. However, if we talk about stripe versus square, they have different strengths and weaknesses, so the best choice for you will depend on your specific needs and budget.

If you are looking for a wide range of features and support for more currencies and payment methods, Stripe is the better choice. Stripe is also more developer-friendly, making it easier to integrate into custom e-commerce platforms.

Frequently asked questions

Here are some most frequently asked questions related to Square vs Stripe:

Is Square or Stripe better for small businesses?

For small businesses, Square may be the better choice due to its user-friendly interface, integrated POS solutions, and suitability for businesses with physical locations. Stripe, while robust for online payments, may be better suited for businesses primarily focused on e-commerce and online transactions.

Which is better Stripe or Square?

The choice between Stripe and Square depends on your specific business needs. Stripe is ideal for online businesses with advanced payment processing requirements, while Square is a versatile option for in-person and online sales, often favored by small businesses and startups.

.png)