Clover vs Square: Which payment processor is right for your business in 2024

All sizes of organizations require a dependable and user-friendly payment processor in the modern digital environment. With so much to choose from, it can be difficult to know where to begin. For this reason, Clover and Square, two of the most widely used payment processors available, are being compared.

We'll compare the features, costs, and usability of Clover and Square in this blog article as we closely examine their differences. Along with conducting interviews, we will also ask business owners who have utilized both processors—Clover vs Square—for their opinions on which is superior.

Clover vs Square: Overview

Here is a brief overview of the Clover and Square:

What is Clover?

Clover is a payment processor and point-of-sale (POS) system that is popular among small businesses. It offers a variety of features, including credit and debit card processing, contactless payments, mobile payments, online payments, inventory management, employee management, and customer loyalty programs.

Clover is easy to use and offers a wide range of features at an affordable price. It is a good choice for small businesses that are looking for a complete payment and POS solution.

Clover is a user-friendly and affordable payment processor and POS system that offers a wide range of features to help small businesses run more efficiently.

What is Square?

Square is a payment processor and point-of-sale (POS) system that is popular among small businesses and individuals. It is a popular choice because it is easy to use, affordable, and offers a variety of features.

Square enables companies to accept credit and debit cards, as well as contactless and mobile payments. It also has POS capabilities including inventory management, employee management, and customer loyalty programs.

Square is a good choice for small businesses that are looking for a simple and affordable payment and POS solution. It is also a good choice for individuals who want to accept payments for goods or services.

Square is an easy-to-use and affordable payment processor and POS system that offers a variety of features to help small businesses and individuals accept payments and manage their businesses more efficiently.

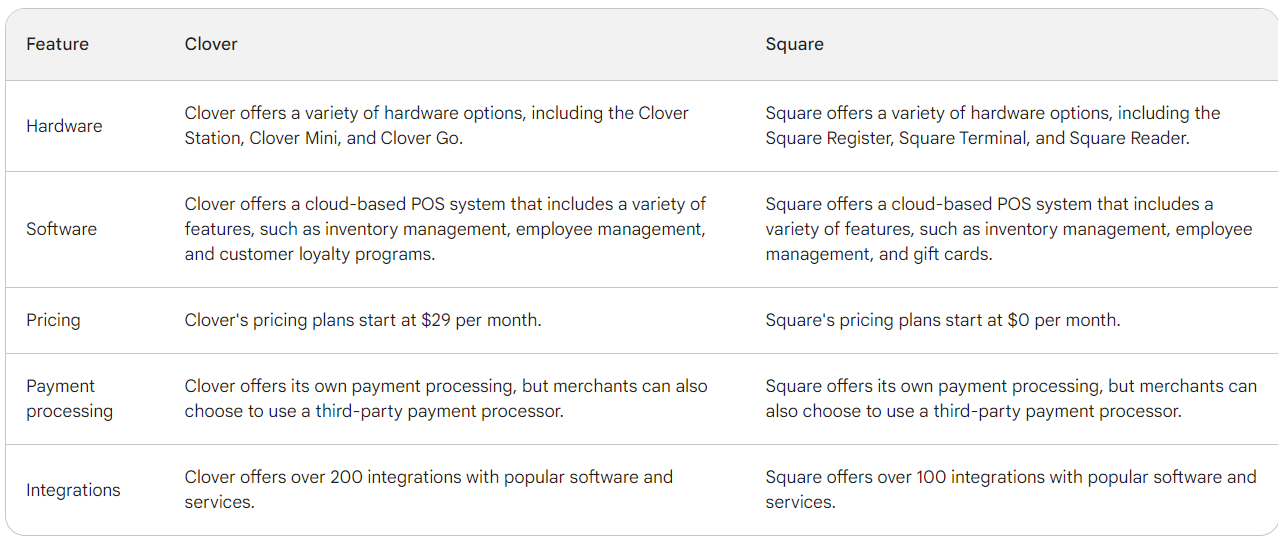

Clover vs Square Comparison Chart

Difference between Clover and Square:

Clover vs Square Features

Some of the key features of each platform to help you compare them so you can decide which is better Square or Clover for your business:

Clover features

Here are the popular features of Clover & Square:

- Customizable POS System

Clover provides a customizable POS system with various hardware options, including countertop terminals, mobile devices, and full POS systems. This allows businesses to choose the hardware that best suits their needs.

- Inventory Management

Offers tools for tracking and managing inventory, enabling businesses to keep track of products, restock efficiently, and analyze sales trends.

- Employee Management

Allows businesses to manage staff, track employee hours, and set permissions for different users.

- Customer Relationship Management (CRM)

Includes features for managing customer information, helping businesses provide personalized service and marketing efforts.

- Reporting and Analytics

Provides reporting tools for tracking sales, analyzing customer behavior, and gaining insights into operations.

- App Marketplace

Clover POS has an app marketplace that offers a range of third-party integrations, allowing businesses to extend the functionality of their Clover system.

- Security and Compliance

Designed to meet Payment Card Industry Data Security Standard (PCI DSS) requirements, ensuring customer payment data is handled securely.

- Offline Mode

Some Clover devices have the capability to process transactions even when there's no internet connection.

- Customer Support

Provides customer support and technical assistance to businesses using their system.

Square features

- Square Point-of-Sale (POS)

It offers a user-friendly POS system that allows businesses to accept payments using various methods, including credit cards, debit cards, mobile payments, and contactless payments.

- Hardware and Payment Options

Provides a variety of hardware options for accepting payments, including card readers, terminals, and mobile devices. It also offers Square Online for e-commerce transactions.

- Invoicing and Online Payment

Enables businesses to send invoices and accept online payments, making it convenient for service-based companies.

- Square App Marketplace

Similar to Clover, Square has an app marketplace with a range of third-party integrations that extend the functionality of the Square platform.

- Business Financing

Square offers financing options for businesses, including loans and cash advances.

- Square Capital

Square Capital is a lending service that offers loans to eligible Square sellers.

- Square Cash (Cash App)

Square owns Cash App, a peer-to-peer payment platform that allows individuals to send and receive money.

- Square Register

Square Register is a fully integrated POS system that combines software and hardware for a seamless payment experience.

Shopify vs Square: Which is Best for Your E-commerce Business

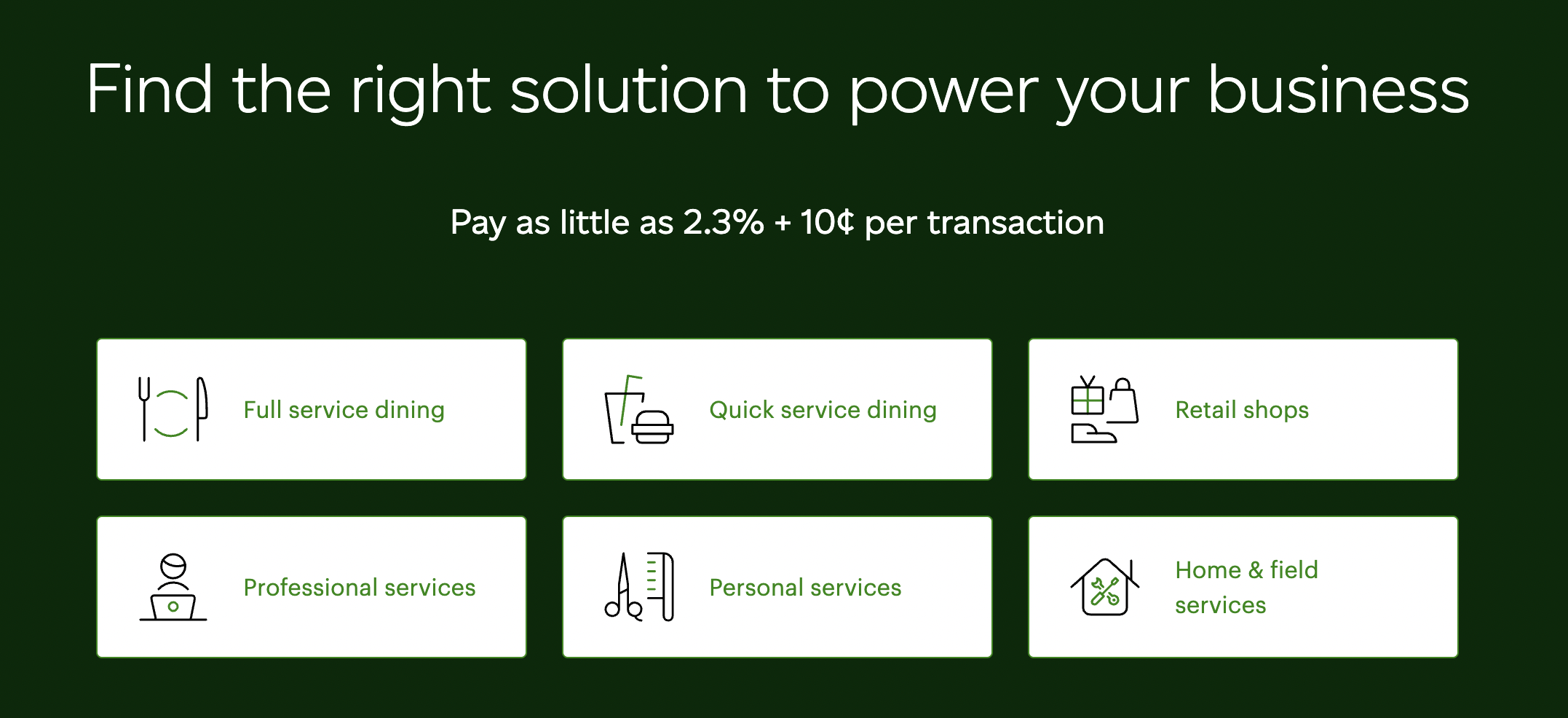

Clover Vs Square Pricing

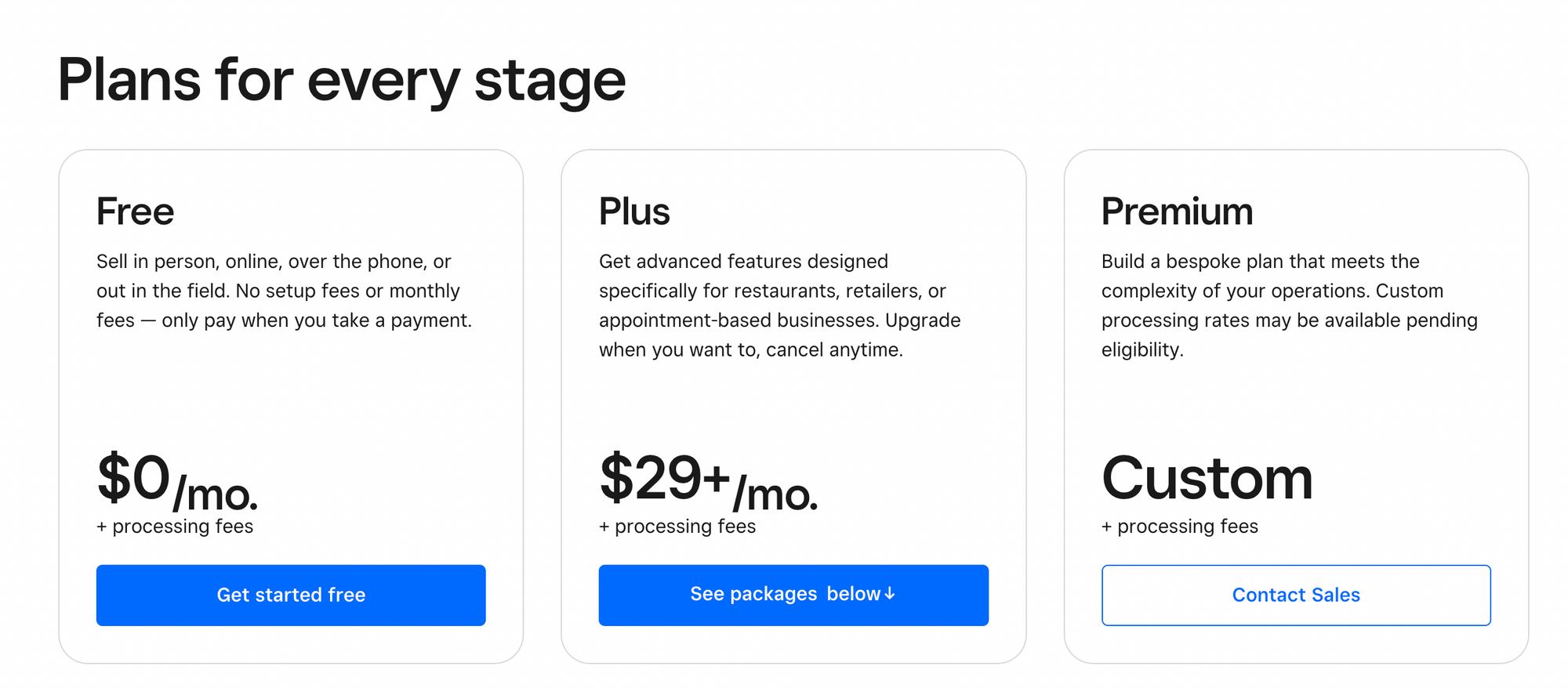

Clover and Square have different pricing structures Clover charges a monthly subscription fee and transaction fees, while Square offers a free plan with transaction fees. Let's discuss the square vs clover fees:

Clover pricing

Square pricing

Clover vs Square Pros & Cons

Below are some of the pros and cons of using Clover and Square as payment processing solutions. Keep in mind that the best choice for your business depends on your specific needs and preferences.

Clover Pros & Cons

Here are the pros & cons of Clover:

Pros:

Customizability: Clover offers a highly customizable POS system with a wide range of hardware options, allowing businesses to tailor their setup to their specific needs.

Comprehensive Inventory Management: Clover provides robust inventory management tools, enabling businesses to efficiently track, manage, and analyze their products.

Employee Management: It offers features for managing employees, tracking hours, and setting permissions, making it useful for businesses with multiple staff members.

Customer Relationship Management (CRM): Clover includes CRM features to help businesses maintain and leverage customer data for personalized service and marketing efforts.

App Marketplace: The Clover App Marketplace allows businesses to extend the functionality of their Clover system with a range of third-party integrations.

Cons:

Potentially Higher Costs: Depending on the specific hardware and services chosen, the initial investment in Clover hardware and software can be relatively high.

Learning Curve: Due to its high customizability, some businesses may find Clover's system requires a learning curve for setup and customization.

Integration Limitations: While the app marketplace offers a range of integrations, some businesses may find that certain specific integrations they require are not available.

Square Pros & Cons

Here are the pros & cons for Square:

Pros:

User-Friendly: Square is known for its user-friendly interface, making it accessible to businesses without extensive technical expertise.

Diverse Payment Options: Square allows businesses to accept a wide range of payment methods, including credit cards, debit cards, mobile payments, and contactless payments.

Invoicing and Online Payments: Square enables businesses to send invoices and accept online payments, making it convenient for service-based businesses.

Robust Reporting Tools: Square provides a variety of reporting and analytics tools to help businesses track sales, customer behavior, and other key metrics.

Square Capital: Square offers financing options for businesses, including loans and cash advances.

Cons:

Limited Customizability: While Square is user-friendly, it may have less customizability compared to Clover, which may not suit businesses with specific customization needs.

Hardware Costs: Depending on the hardware chosen, the initial investment in Square hardware can also be a factor.

Transaction Fees: While Square offers competitive rates, transaction fees can still be a consideration for high-volume businesses.

Clover vs Square Integrations

Clover and Square are both popular point-of-sale (POS) systems that offer a wide range of integrations with other software and services. This can help businesses to streamline their operations and improve their customer experience.

Here is a comparison of Clover and Square integrations:

Clover Integrations

- Clover offers over 200 integrations with popular software and services, including accounting software, CRM systems, e-commerce platforms, and payment processors.

- Some of Clover's most popular integrations include:

- QuickBooks Online

- Xero

- Salesforce

- Shopify

- WooCommerce

- PayPal

- Stripe

- Clover also offers a custom integration platform that allows businesses to connect their POS system to any software or service that they use.

Square Integrations

- Square offers over 100 integrations with popular software and services.

- Some of Square's most popular integrations include:

- QuickBooks Online

- Xero

- Salesforce

- Shopify

- WooCommerce

- PayPal

- Stripe

- Square also offers a custom integration platform that allows businesses to connect their POS system to any software or service that they use.

Clover vs Square Alternatives

In addition to Clover and Square, there are several other payment processing and point-of-sale (POS) alternatives available for businesses. Here are some popular alternatives to consider:

Stripe

Stripe is a powerful online payment processing platform that caters to businesses operating on web and mobile applications. It offers a suite of developer-friendly tools and APIs, making it an excellent choice for e-commerce businesses. With support for subscriptions, marketplace payments, and various international currencies, Stripe provides a highly customizable and versatile payment solution.

PayPal

PayPal Here is a mobile card reader solution that allows businesses to accept in-person payments. It seamlessly integrates with PayPal's online payment system, offering a trusted and widely recognized platform. In addition to in-person transactions, PayPal Here provides features for invoicing and basic inventory management. While fees may be higher for certain types of transactions, PayPal.

Shopify POS

Shopify POS is a point-of-sale system designed for businesses with a strong online presence. It integrates seamlessly with Shopify's e-commerce platform, allowing a unified sales experience across physical and online channels. With features like inventory management and support for various payment methods, Shopify POS is an excellent choice for businesses focused on e-commerce.

Lightspeed

Lightspeed offers a comprehensive point-of-sale system tailored to retail and hospitality businesses. It provides robust features for inventory management, customer relationship management, and reporting. With its broad range of capabilities, Lightspeed is well-suited for a wide variety of retail and restaurant establishments. While pricing may be higher compared to some alternatives, the platform's feature set justifies the investment for businesses with complex needs.

Clover vs Square Market Share

Clover has a market share of 5.56% in the point-of-sale (POS) systems market, while Square has a market share of 27.65%. This means that Square is currently the more popular payment processor, with a significantly larger market share than Clover.

Here are some of the reasons why Square may have a larger market share than Clover:

Features: Square offers a variety of features that are popular with small businesses, such as inventory management, employee management, and customer loyalty programs. Clover also offers these features, but they are not as user-friendly or as comprehensive as Square's features.

Ease of use: Square is known for being a very user-friendly platform. Clover is also easy to use, but it is not as user-friendly as Square.

Brand awareness: Square is a more well-known brand than Clover. This is likely due to Square's extensive marketing campaigns and its popularity among small businesses.

Complementing Payment Processors with AI: Manifest AI's Role

When evaluating payment processors like Clover and Square for your business in 2024, it's also worth considering how additional tools like Manifest AI can complement these systems. While Clover and Square efficiently handle transactions, Manifest AI enhances the overall customer experience.

- Personalized Prodoct Recommendation: Manifest AI can interact with customers, providing personalized assistance, product discovery and product recommendations.

- Efficient Query Handling: It addresses customer inquiries quickly, complementing the smooth payment process offered by Clover and Square.

- Data-Driven Insights: Manifest AI analyzes customer interactions, offering insights that can help in tailoring marketing and sales strategies.

- 24/7 Support: Its round-the-clock availability ensures continuous customer engagement, supplementing the accessibility of Clover and Square.

Integrating Manifest AI with your chosen payment processor can lead to a more holistic approach to business operations, where payment efficiency and customer interaction work hand in hand.

Final thoughts

Both Clover and Square are good payment processors for small businesses, but they offer distinct advantages and disadvantages. Clover is a fantastic choice for businesses that require a more powerful POS system with a variety of features, whereas Square is a suitable alternative for businesses that require a simple and economical POS system. To choose which payment processor is ideal for your company, evaluate the cost, functionality, and hardware options provided by Clover and Square. You should also evaluate your company's specific requirements and budget.

If you are still undecided about which payment processor is best for you, both Clover and Square offer free trials. This will allow you to determine which POS system is best for you.

.png)