Stripe vs Adyen Showdown: Choosing Your 2024 Gateway

Choosing the right payment gateway is crucial for businesses aiming to streamline their transactions and enhance customer satisfaction. Stripe and Adyen are leading contenders in the payment solutions arena, each supporting billions of dollars in transactions annually.

This blog will delve into a detailed comparison of Stripe versus Adyen, focusing on their features, costs, and user experiences. We’ll examine their global reach, transaction fees, integration capabilities, and security measures to help you determine which gateway aligns best with your business needs for the upcoming year. Join us as we navigate through the specifics to aid your decision-making in this critical aspect of business operations.

Stripe vs Adyen: Meaning

Here is a simple explanation of both of the payment gateways:

What is Stripe?

Stripe is a payment processing platform designed to facilitate online and mobile transactions. It allows businesses of all sizes to accept payments over the Internet, offering tools to manage revenue, prevent fraud, and expand operations globally. Stripe's user-friendly interface and comprehensive suite of features make it a popular choice for e-commerce sites, mobile applications, and subscription-based services.

The Stripe payment services support a wide range of payment methods, including credit cards, bank transfers, and alternative payment options, catering to a global customer base. With its focus on technology and flexibility, Stripe's business model aims to remove the complexity of financial transactions, enabling businesses to focus more on their growth and less on payment logistics.

What is Adyen?

Adyen is a global payment company that offers businesses of all sizes a single platform to accept payments anywhere in the world. Launched in 2006, it has grown to support online, mobile, and in-store transactions, making it versatile for various business models. Adyen payment processor provides a seamless payment experience for customers by supporting a wide range of payment methods, including credit cards, bank transfers, and e-wallets.

It's designed to simplify the payment process, from transaction to settlement, with a focus on security and anti-fraud measures. The platform is favored by businesses looking for an efficient way to manage international payments and gain insights into their payment data to help drive growth and improve customer experiences.

Square vs Stripe

Stripe vs Adyen: Features

Here are the best features of Stripe and Adyen:

Stripe Features

- Customizable Checkout: Offers a flexible, embeddable checkout process that can be tailored to match your site’s design.

- Extensive Payment Options: Accepts a wide range of payment methods including credit cards, digital wallets, and bank transfers.

- Developer Tools: Provides comprehensive APIs and developer tools for custom integrations.

- Subscription Management: Includes tools for managing recurring payments and subscriptions.

- Fraud Protection: Comes with built-in tools to detect and prevent fraudulent transactions.

- Global Reach: Supports multiple currencies and payment methods tailored for international customers.

Adyen Features

- Unified Commerce Solution: Allows businesses to accept payments online, on mobile, and in-store through a single platform.

- Local Payment Methods: Offers a wide variety of local payment options to cater to customers worldwide.

- Risk Management: Features advanced risk management tools to minimize fraud and secure transactions.

- Payment Analytics: Provides real-time insights into payment data to help businesses make informed decisions.

- Revenue Optimization: Tools designed to increase authorization rates and optimize revenue.

- Customization and Integration: Offers flexible integration options for a seamless payment experience across various platforms.

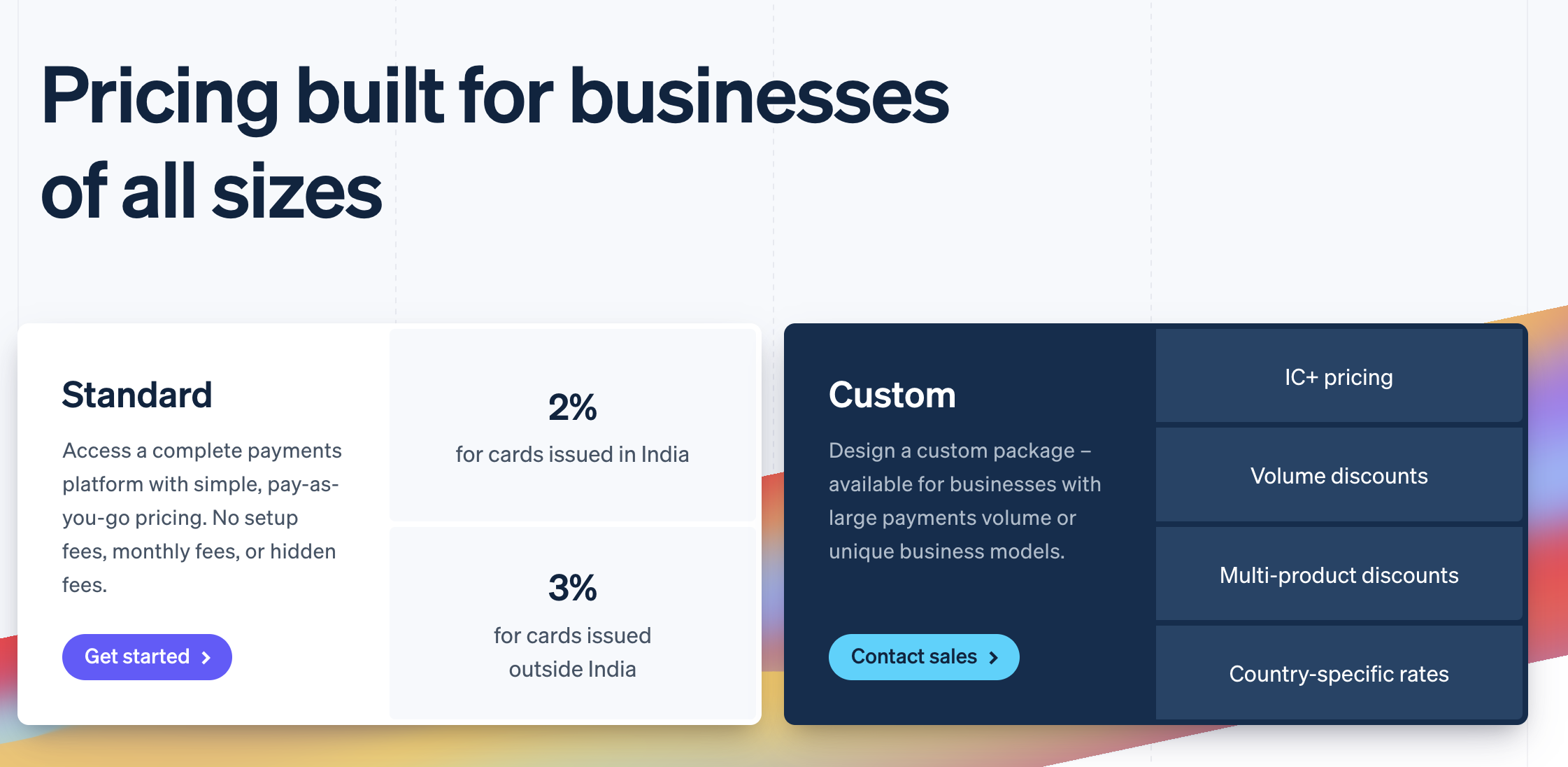

Adyen vs Stripe Pricing

When evaluating Adyen versus Stripe, understanding their pricing structures is crucial for businesses to decide which platform aligns best with their financial and operational needs. Here's a detailed comparison based on the latest available information:

Stripe Pricing

- Transaction Fees: Stripe charges a standard transaction fee for online payments, typically around 2.9% + 30 cents per successful card charge for businesses in the United States. Fees may vary by country.

- International Cards: Transactions with international cards are subject to an additional 1% fee, and another 1% fee if currency conversion is necessary.

- Subscription & Recurring Payments: Stripe offers billing solutions for subscriptions with variable pricing based on the number of invoices and the level of customization required.

- Additional Products: Stripe provides various add-ons like Stripe Radar for fraud detection, which comes with its own pricing, usually a small percentage of each transaction or a flat fee for more advanced features.

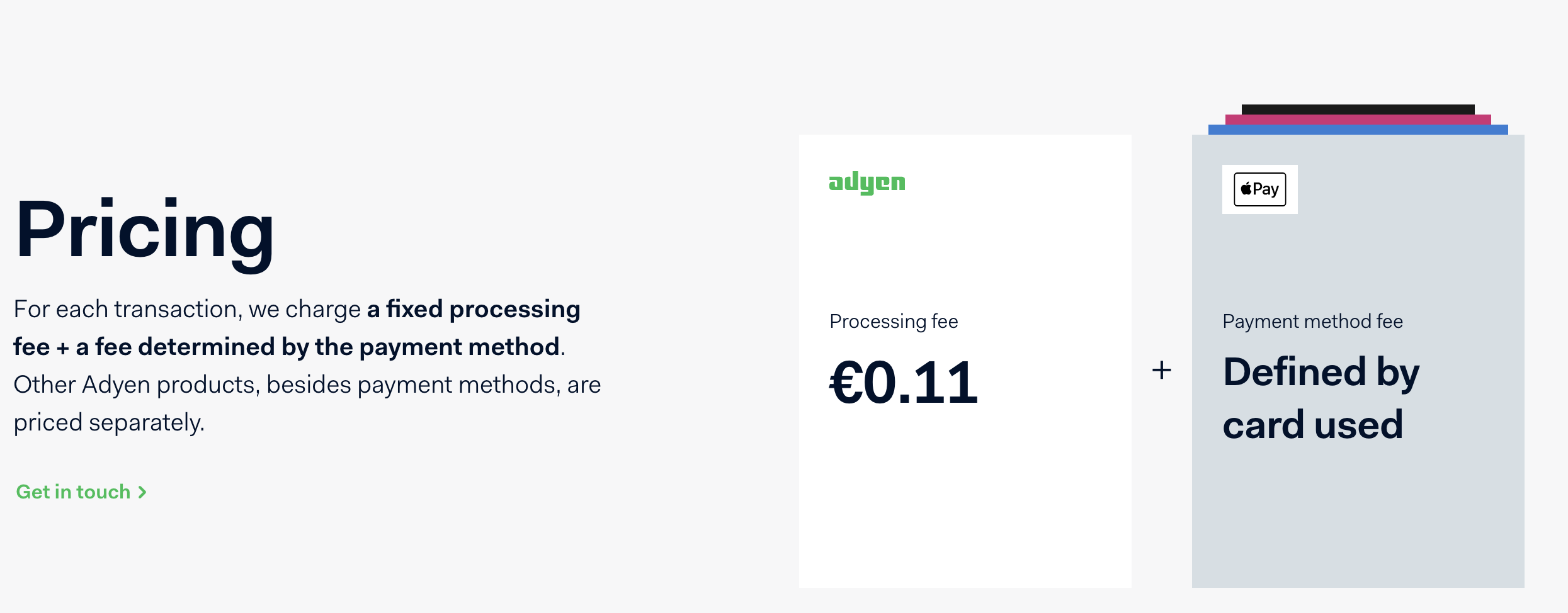

Adyen Pricing

- Transaction Fees: Adyen’s pricing model is known for its transparency and lack of hidden fees. It charges a processing fee plus a payment method fee, which varies depending on the payment method used. The company customizes its pricing for each merchant based on factors like transaction volume and geographical location.

- Interchange++ Pricing Model: Unlike many of its Adyen competitors use an Interchange++ pricing model for card transactions, which involves passing through the interchange fees set by card networks, plus scheme fees and a small markup by Adyen.

- No Setup or Monthly Fees: Adyen doesn't charge setup or monthly fees, making it accessible for businesses of all sizes.

- Additional Features: For specific services like risk management tools or advanced analytics, Adyen may offer these under a separate pricing scheme, tailored to the merchant’s usage.

Klarna vs Afterpay

Stripe vs Adyen Reviews

Here are the advantages and disadvantages of Adyen and Stripe:

Stripe Pros and Cons

Stripe Pros

- Ease of Integration: Stripe provides comprehensive APIs and developer tools that make it easy to integrate into various e-commerce platforms and custom applications.

- Global Payment Options: Supports a wide range of payment methods including credit cards, digital wallets, and direct bank transfers, catering to customers worldwide.

- Transparent Pricing: Offers clear, straightforward pricing with no hidden fees, making it easier for businesses to understand their costs.

- Robust Security Features: Includes advanced security measures and compliance with PCI DSS standards to protect sensitive data.

- Subscription Services: Comes with built-in support for subscription-based business models, including billing and invoicing functionalities.

- Developer-Friendly: Extensive documentation and strong developer support make it a preferred choice for tech-savvy businesses.

Stripe Cons

- Complexity for Non-Developers: While it's highly customizable, the platform can be complex to navigate for those without technical expertise.

- Higher Fees for International Transactions: International transactions incur additional fees, which can add up for businesses serving a global market.

- Limited Customer Support: Some users report challenges with reaching customer support promptly, relying heavily on email and chat support.

- Potential for Account Stability Issues: Stripe reserves the right to freeze or terminate accounts due to high-risk transactions or other security concerns, sometimes without prior notice.

- No Dedicated Merchant Account: Stripe operates with an aggregated merchant model, meaning businesses share a collective merchant account, which may not suit everyone’s preferences.

Adyen Pros & Cons

Adyen Pros

- Global Payment Solution: Supports a wide range of local and international payment methods, making it ideal for businesses looking to expand globally.

- Transparent Pricing: Adopts an Interchange++ pricing model that can offer more transparency and potentially lower costs for merchants.

- No Setup or Monthly Fees: Charges no setup or monthly fees, reducing overhead costs for businesses.

- Unified Commerce Platform: Offers a single platform for accepting payments online, on mobile, and in-store, facilitating a seamless payment experience across all channels.

- Advanced Fraud Protection: Provides sophisticated risk management tools to help safeguard transactions against fraud.

- Detailed Analytics and Reporting: Delivers comprehensive insights into payment data, helping businesses make informed decisions.

- Customization and Flexibility: Allows for a high degree of customization in how payments are processed and managed.

Adyen Cons

- Complex for Smaller Businesses: The wide array of features and the Interchange++ model may be overwhelming for smaller businesses or those new to e-commerce.

- Custom Pricing Could Be a Barrier: While potentially cost-effective for high volumes, obtaining custom pricing means you need to engage in discussions with Adyen, which might delay setup.

- Integration Complexity: The rich feature set and customization options might require more technical resources to integrate and manage effectively.

- Minimum Transaction Volume Requirements: Some tailored pricing options or features might only be available to businesses with higher transaction volumes.

- Limited Immediate Support for Small Merchants: Larger businesses might receive more immediate and comprehensive support due to the nature of their accounts.

Stripe vs Adyen: Competitors

Here is the list of some popular competitors of Stripe & Adyen:

- PayPal: A widely recognized name in the payment processing industry, PayPal offers a range of solutions for businesses and consumers alike. It's known for its ease of use, extensive user base, and the ability to handle international transactions.

- Square: Initially focused on in-person payment solutions with its innovative hardware, Square has expanded to offer a full suite of online payment processing tools. It's particularly popular among small businesses for its straightforward fees and user-friendly interface.

- Braintree: Owned by PayPal, Braintree offers a more developer-focused approach to payment processing, with advanced customization options for online, mobile, and in-app payments. It's chosen by businesses looking for a high degree of integration flexibility.

- Worldpay: As one of the largest payment processing companies globally, Worldpay offers a vast array of services for businesses of all sizes, including online, in-store, and mobile payments, with strong support for international transactions.

Conclusion

Choosing between Stripe and Adyen for your 2024 payment gateway involves carefully considering your business's specific needs. Both platforms offer robust solutions that cater to a wide range of transactional requirements, from global scalability to detailed customization options. By analyzing their fee structures, integration ease, and security features, you can select a gateway that not only enhances your operational efficiency but also supports your growth ambitions. Make an informed decision based on the detailed insights provided, ensuring that your choice aligns with your strategic goals and customer engagement strategies.

FAQs

Stripe vs Adyen: Which is best for an e-commerce business?

Choosing between Stripe and Adyen for an e-commerce business depends on specific needs. Stripe is favored for its ease of integration and developer-friendly tools, ideal for startups and tech-focused businesses. Adyen offers extensive global payment options and transparent pricing, making it suitable for businesses aiming for international expansion.

Is Stripe better than Adyen?

Deciding whether Stripe or Adyen is better for an e-commerce business depends on the specific needs of the business. Stripe is often favored for its ease of use and extensive developer tools, making it ideal for startups and businesses focused on customization. Adyen, on the other hand, offers robust global payment solutions and transparent pricing, which may be more appealing for businesses with a strong international presence.

Why Stripe is cheaper than Adyen?

Stripe may appear cheaper than Adyen for some businesses due to its straightforward pricing structure, which is often preferred by startups and small enterprises for its predictability. However, the best choice for an e-commerce business depends on specific needs such as global reach, payment options, and customization capabilities. Adyen's tailored pricing can offer value for businesses with high transaction volumes and diverse global operations

.png)